The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 09/10/2025

How can the government improve investment conditions for construction in the Autumn Budget? With a vast hole in public funds to somehow fill and a raft of political and social pressures to balance, there’s certainly no easy answer. However, as BCIS chief economist Dr David Crosthwaite explores, the best way forward for construction and the wider economy is a business-first approach.

Autumn Budget: look after SMEs and construction will look after itself

November’s Autumn Budget is shaping up to be a tough gig.

Economic growth is stalling and the risk of a productivity downgrade from the Office for Budget Responsibility could leave the government scrabbling to make ends meet.

The Budget’s outcome will likely have implications for investment conditions and, as far as construction and the wider economy are concerned, reducing SME business costs should be a priority.

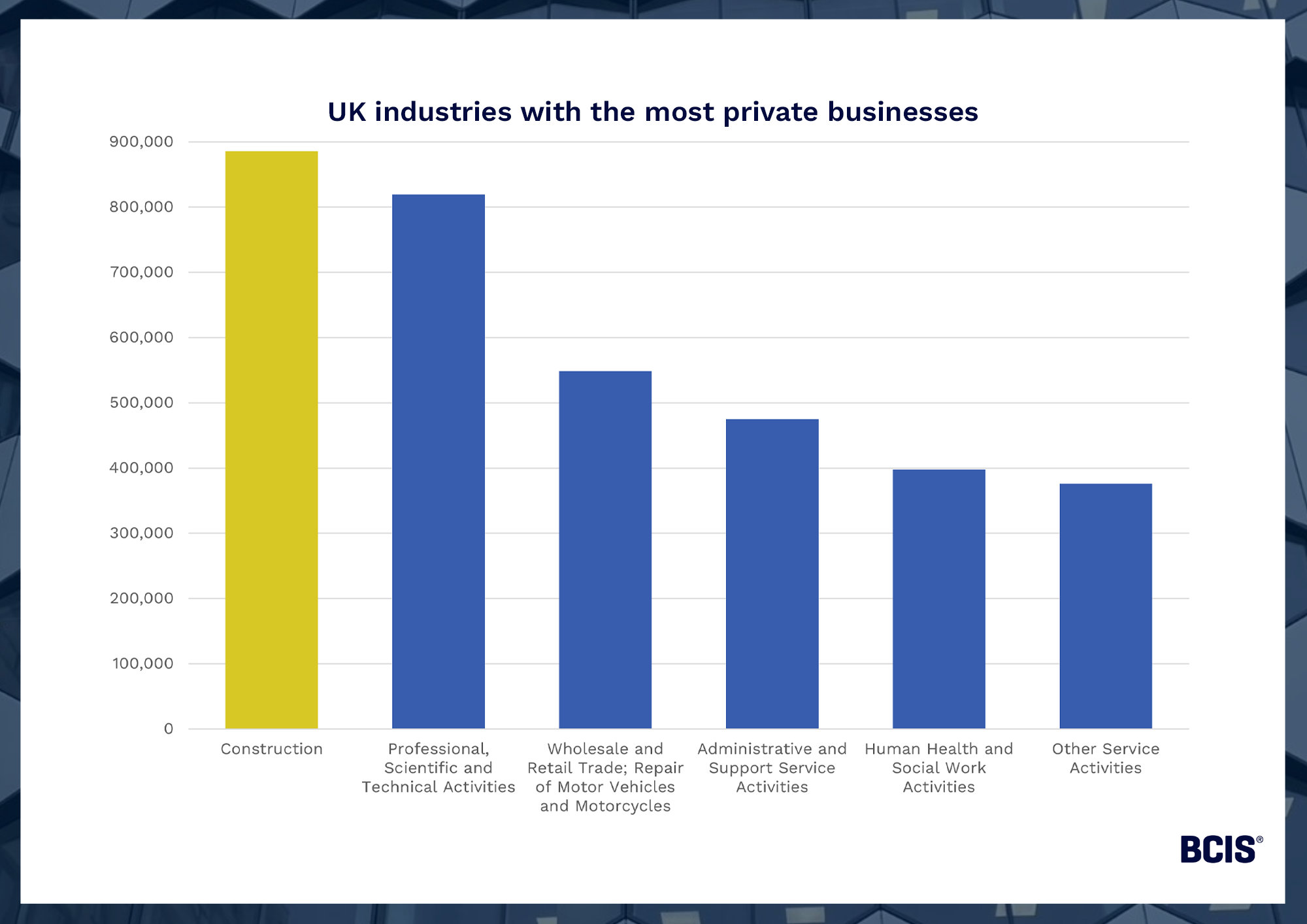

SMEs are the backbone of the private sector. New data from the Department for Business and Trade(1) show that SMEs comprise 99% of the overall business population in each of the main industry sectors with construction boasting the largest overall share – 885,000 or 16% to be specific.

Source: DBT – Business population estimates for the UK and regions 2025, Table 4

The negative impact of high business costs on investment conditions is therefore no surprise as they typically affect SMEs disproportionately due to their limited cash flow and reduced ability to absorb financial shocks – especially in a volatile sector like construction.

The greatest impact was the increase to employers’ National Insurance Contributions (NICs) in April.

This has been particularly bad news for construction with many SMEs already operating on wafer thin margins at a time of soaring labour costs.

The latest Agents’ summary of business conditions from the Bank of England shed light on the situation across sectors, reporting subdued investment conditions for the year ahead amid uncertainty over domestic policy, weak demand and financial constraints(2).

In construction, the summary also underlined the ongoing impact of project delays which are reportedly dampening progress on commercial and public sector projects and led to flat or lower output in construction-facing manufacturing in 3Q2025.

Promisingly, BCIS forecasts output growth in the new year and, while this will be modest due to the stagflationary economic environment, both the government and construction SMEs have the power to make 2026 more prosperous.

The first port of call is cutting business costs.

The Chancellor’s ambitions are constrained by her own fiscal rules and, despite the political ramifications of a manifesto U-turn, it’s essential the government explores other tax avenues.

When you increase the cost of doing business, everyone loses out. It lowers investment impetus and is arguably more detrimental to working people by restricting employment opportunities and job security.

ONS data show unemployment is rising; 4.7% of the population did not have a job in the three-month period ending in July 2025 – the same level recorded in the previous two three-month periods and the highest level since 2Q2021(3).

Construction is one of the most important sectors when it comes to driving economic growth and putting money back into people’s pockets; its multiplier effect stimulates productivity across other sectors.

Construction’s integration with the wider economy means sector-specific measures in the Budget won’t be enough to drive growth. Instead, SMEs across the board must benefit from lower business costs to make a difference.

Further, the government must stick by its promises to invest in infrastructure and housing.

Speculation suggests the Chancellor faces a £30 billion black hole in the public finances but making project cuts will do far more harm than good in the long term.

Investment in built assets can support economic growth over many years and should not be sacrificed so the government can save face on its tax pledges.

Regardless of the Budget outcome, construction firms (SMEs in particular) should continue to follow best practice to protect their cash flow.

A survey commissioned by the Federation of Master Builders and the Chartered Institute of Building found that almost half of micro and SME building firms reported lower-than-expected profits or losses in the first half of 2025(4).

67% experienced rising wages which, when combined with other cost increases, led to around one-third restricting recruitment and 22% making redundancies.

Adapting to cost risks is challenging but measures such as better forecasting, building resilience, early risk management and maintaining strong communication across the supply chain can be effective mitigation strategies.

Now more than ever, contractor-client collaboration on setting realistic programmes, careful cost planning and fair risk allocation are pivotal to avoid project or even business failures.

As the supplier, offering a compelling value proposition can help to persuade clients away from a protracted tender process although this should not come at the detriment of cash flow.

SMEs particularly should avoid diversifying from their core market. While there may be a temptation to explore other opportunities and win work with lower bids, new entrants will be exposed to unfamiliar clients and projects that may have a higher risk profile.

Amid uncertainty, construction firms should stick to known markets and due diligence, such as establishing a project bank account to manage payments and maintain cash flow.

The Budget is a further opportunity to kickstart the economy but if that fails and business costs remain high, or worse, increase, construction firms must continue with prudence and business as usual – now and post-Budget.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) GOV.UK – Business population estimates for the UK and regions 2025: statistical release – here

(2) Bank of England – Agents’ summary of business conditions – 2025 Q3– here

(3) Office for National Statistics – Unemployment rate (aged 16 and over, seasonally adjusted): % – here

(4) CIOB – The SME State of Trade Survey, January to June 2025 – here