The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 21/01/2026

Post-Budget uncertainty, inflation and interest rates are softening and there are small signs of growing business optimism.

However, improved investment conditions in 2026 are far from assured and with many of the same challenges still weighing on construction activity, contractors will no doubt continue to favour the safest procurement paths forward.

Looking to 2025 for clues about future procurement trends is useful. Imbalanced risk allocation, wider economic volatility and uncertainty and high construction costs have all muted contractors’ appetite for risk and prompted contractors to be more selective in the tenders they pursued. Many of these factors are still present now, albeit to a lesser extent in some cases.

Reluctance toward single-stage design and build procurement has been persistent, largely due to limited early collaboration and pricing risk.

For some this route has been viable, but as highlighted by the BCIS Tender Price Index Panel (TPI), many contractors continue to favour two-stage or negotiated tendering where they have more control over pricing.

Compliance with the Building Safety Act has further discouraged use of the single-stage design and build approach.

Applications for building control approval (gateway 2) call for detailed designs pre-construction which goes against this procurement model where designs are often padded out after works have started.

Elsewhere, anecdotal evidence suggests contractors have been favouring target cost contracts and are pricing the risk of volatility into fixed-price contracts, especially those with a long programme.

Last year the panel also noted that contractor tender selectivity is increasingly based on the competition, who the client is and the nature of work being bid for. This is coupled with a common aversion to large, complex projects and the adoption of a hybrid two-stage route in some cases where more fixed elements are introduced in the first stage.

It’s likely these trends will continue into 2026.

Construction costs are rising – BCIS estimates a 15% increase in building costs in the next five years – which means contractors are still being squeezed by demand- and supply-side cost pressures.

There is ultimately less financial wiggle room for contractors to absorb the fallout from investing time and resources in bids that don’t land and the cost uncertainties that can come with rushed designs, less design input or limited collaboration with the client and other stakeholders.

That’s not to say contractor appetite to tender is weak.

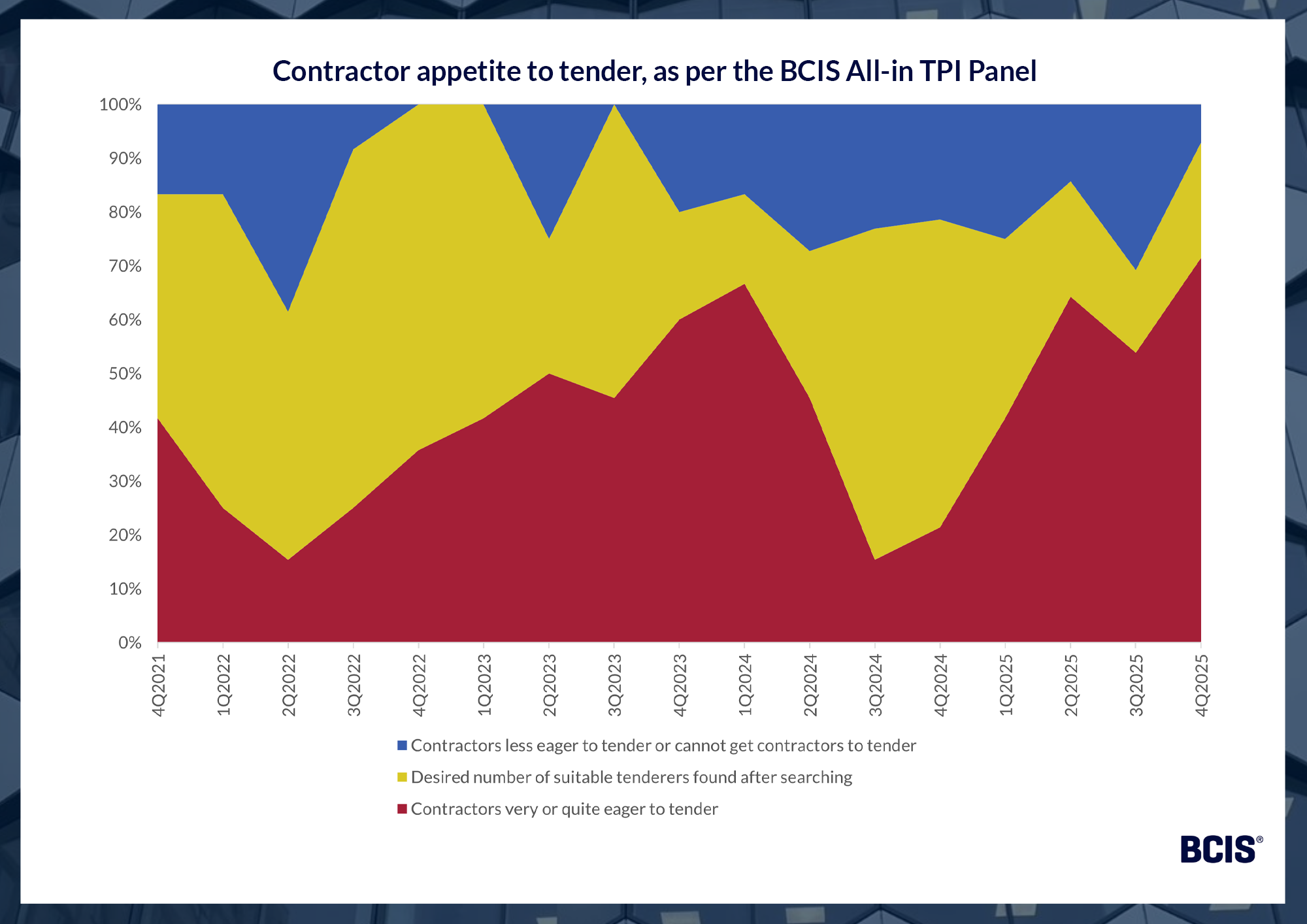

Throughout 2025, more than 40% of BCIS TPI panel survey respondents, comprising practicing cost consultants involved in multiple tenders each quarter, consistently found contractors quite eager to tender.

Source: BCIS TPI Panel

This peaked at 71% of respondents in 4Q2025 – the highest proportion in the last five years.

At the latest meeting of the BCIS TPI Panel in 4Q2025, panellists expanded on this. Looking ahead, they underlined concerns over contractor order books in late 2026, with reports suggesting some regional contractors are prepared to diversify into different markets to retain their margins.

So where does this leave procurement trends for the coming months?

It’s likely that an aversion to single-stage design and build procurement will remain in the near-term.

CPI inflation and the cost of borrowing might be easing but contractors could still face shrinking margins as elevated business and construction costs persist and the inflationary pressure of skills shortages bite.

At the same time, contractors could well be asked to do more with less as clients push for project starts. Many clients themselves face the pressure of wage increases and growing business costs and are naturally looking for better value for money.

Continued preference for two-stage and negotiated tendering is to be expected as contractors seek secure, well-funded work. That said, a reported reduction in private sector tendering opportunities could prompt contractors to consider other routes.

Frameworks, for instance, which can reduce the tendering burden on contractors while increasing pipeline predictability and visibility. This approach can also afford clients more competitive tender prices, greater time and cost efficiency and budget confidence.

A stronger market shaping of procurement trends could also be on the cards.

BCIS TPI Panel observations shed light on promising public sector prospects at the tail end of 2025, particularly across the healthcare, justice and defence sectors, as well as the increased demand in the data centre space.

Should private sector market conditions remain sluggish, risk-led procurement could shift if contractors are forced to bid for the work that’s available and choose cash flow over caution.

Procurement preferences aside, client- and contractor-side cost consultants will, as ever, have a pivotal role in balancing project value with market realism.

Utilising construction-specific cost tools will help to evidence project cost drivers to clients and allow them to better understand what they’re asking of contractors. The same goes for contractor teams – for instance, using BCIS cost data to support contract negotiation.

Client budgets and contractor margins are ultimately both up against a stagnant economy.

How well both parties understand and manage cost risks in the months to come will play a key role in how procurement trends pan out.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.