The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 08/12/2025

Ahead of the Autumn Budget, BCIS set out eight key areas where construction professionals were hoping for clarity, stability and support. With confidence across the sector tied closely to inflation expectations, investment conditions and visibility of future workloads, this fiscal event was a key opportunity for the government to reset the tone.

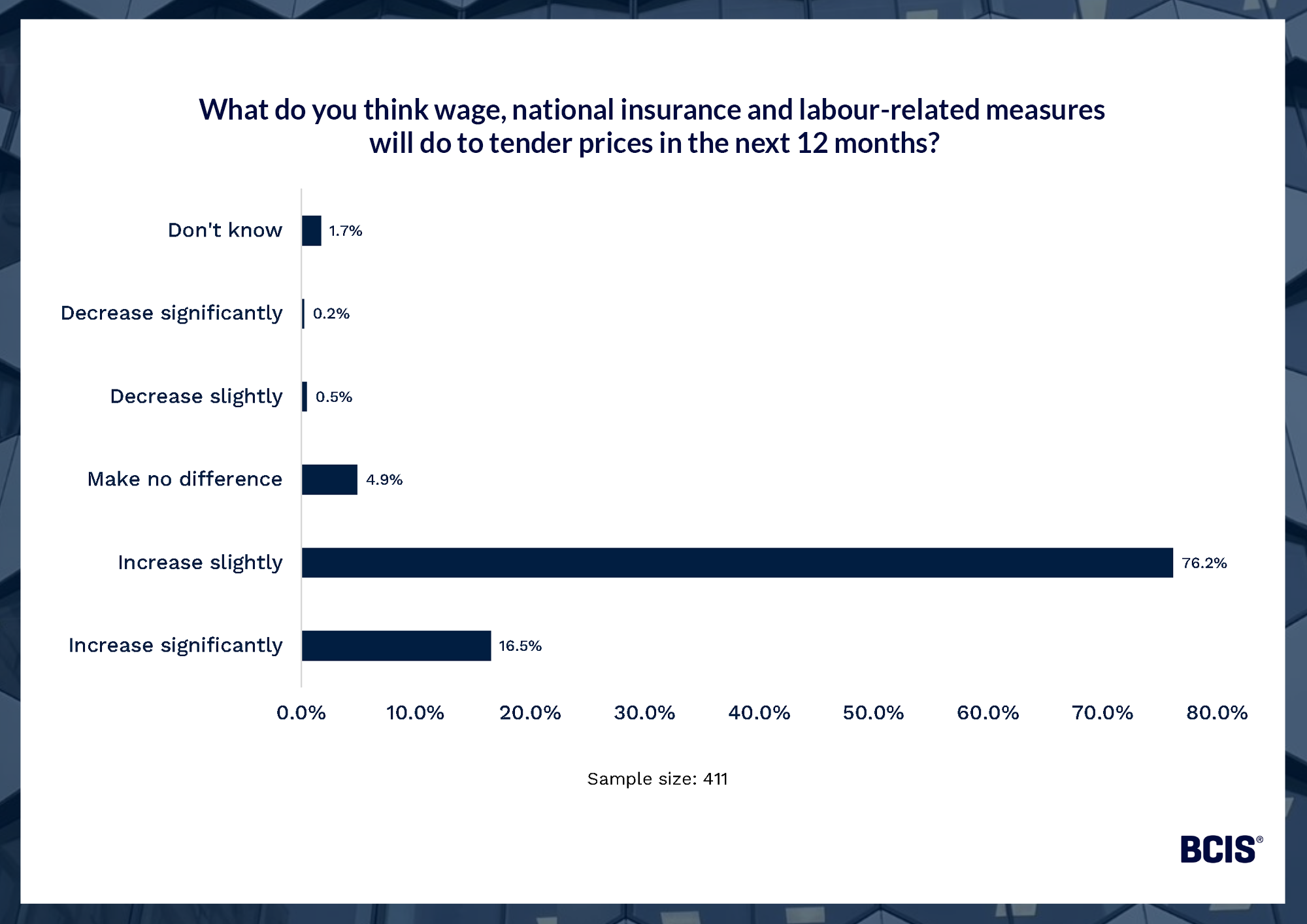

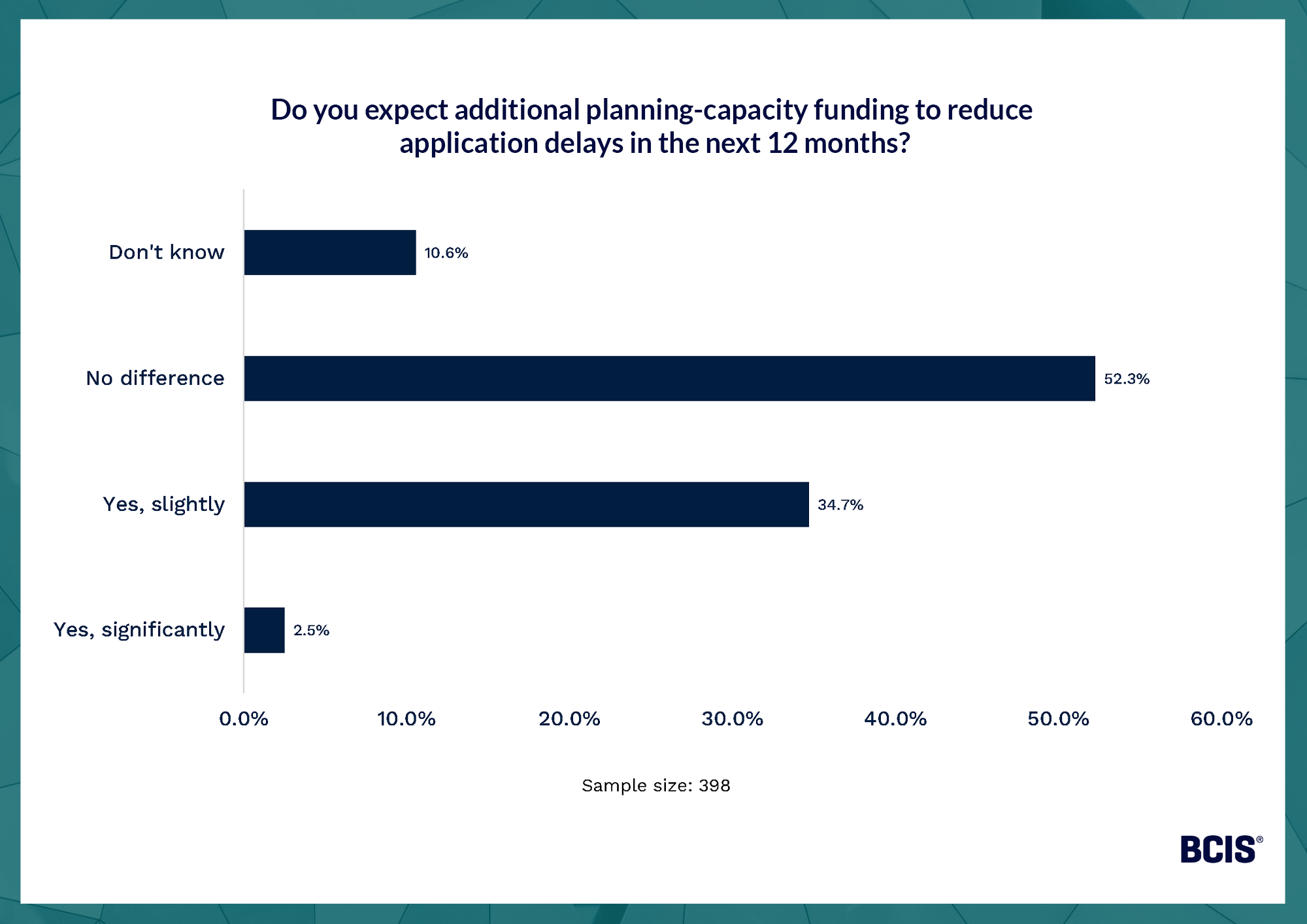

Here, our chief economist, Dr David Crosthwaite, assesses what the Chancellor delivered against each of the priorities we highlighted. We also polled the attendees of our recent Autumn Budget and the Built Environment webinar, to see how they think the sector will fare in the post-Budget economic climate – results of the poll questions are included below.

What we hoped for: Relief from rising taxes and regulatory pressures, particularly for SMEs.

What we got: Business costs continuing to rise, increasing inflationary pressure and squeezing margins.

The Budget confirmed further above-inflation increases to the National Living Wage and National Minimum Wage from April 2026, which is on top of increases in effect from April of this year. While intended to support younger workers, these changes raise employment costs at a time when contractors are already facing higher wage bills, labour shortages and increased National Insurance costs.

The government also confirmed a freeze on the secondary threshold for employer NICs from 2028, and a future cap on tax-free employee pension contributions, both of which will add to the long-term cost of hiring staff. None of this supports our call for easing business costs to stimulate confidence and investment.

What we hoped for: Short-term measures to relieve labour bottlenecks.

What we got: Some support, but not enough to shift the fundamentals.

A positive development for labour supply was free training for under-25 apprentices in SMEs. This may help over time, but the scale falls far short of addressing deep workforce shortages. ONS data suggests the construction workforce has fallen to a near-25-year low.

There were no new interventions to ease materials-related pressures, support import resilience or stabilise subcontractor availability.

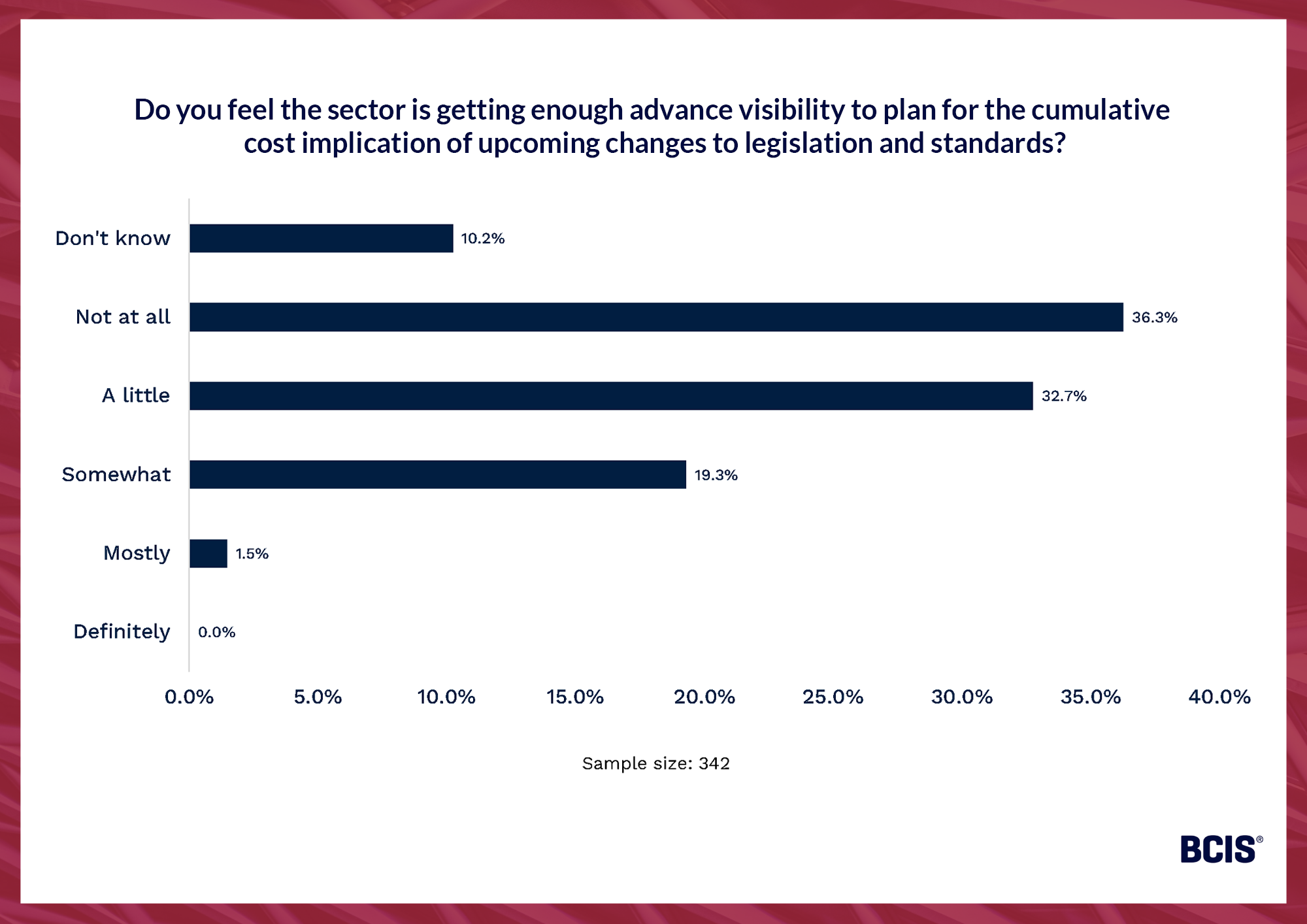

Source: BCIS Autumn Budget and the Built Environment webinar, 4 December 2025

What we hoped for: Clearer private finance mechanisms and funding models to unlock stalled projects.

What we got: Very little. Financing constraints remain a key barrier to delivery.

Despite referencing the importance of private investment, the Chancellor did not outline concrete steps to improve finance conditions for developers or contractors. There were no new guarantee schemes, no clarity on private finance for other major programmes, and no targeted interventions for SME builders.

There was confirmation of a new PPP (public-private partnership) model being developed by NISTA to fund the ‘vast majority’ of up to 250 neighbourhood health centres, of which almost half are due to be operational by 2030. And privately financed projects and programmes – including PPPs – will be considered for projects that decarbonise the public sector estate.

What we hoped for: Investment in planning capacity to help alleviate delays.

What we got: A meaningful step forward, but implementation will take time.

The government announced an additional £48 million over three years for MHCLG, DSIT and Defra to improve planning capacity, including funding for approximately 350 new planners. This responds directly to concerns raised by the Royal Town Planning Institute (RTPI) about an overstretched planning workforce.

While this will not resolve delays overnight, it is one of the more tangible Budget commitments for improving the delivery environment that the RTPI welcomed – but it also stressed the importance of long-term investment. Over the last 15 years the RTPI says there has been a 28.8% reduction in funding to planning policy teams.

What we hoped for: Stronger funding timetables and clearer investment signals.

What we got: Some clarity, but the overall pipeline remains opaque.

The Budget confirmed an additional £891 million for the Lower Thames Crossing, and stated intent to improve complex nuclear regulation – both signals of continued infrastructure investment. However, broader visibility across the pipeline remains unchanged. The next update to the Infrastructure Pipeline is due at the beginning of 2026, so we’ll be hoping for clearer funding timetables and firmer investment signals. Lots of the projects in there don’t currently have defined budgets.

Source: BCIS Autumn Budget and the Built Environment webinar, 4 December 2025

What we hoped for: Demand-side support or viability measures to help reverse declining growth in net additions.

What we got: Almost nothing new. Hard to see how housing trends are going to shift in the short term.

The Chancellor did not announce measures to support demand, improve viability or address barriers facing SME developers. Despite this, the Budget document reaffirmed the government’s commitment to delivering 1.5 million homes this Parliament, even as data shows progress is far off-track.

What we hoped for: Clarity on timing and transitional arrangements.

What we got: No mention of either.

There were no updates on the FHS or FBS in the Budget. With housebuilders already navigating rising compliance costs, including the upcoming Building Safety Levy, this lack of clarity risks further hesitation in the market. There is also a delay to the Warm Homes Plan, adding uncertainty to workload planning in 2026.

What we hoped for: Direction of travel toward whole life carbon measuring and reporting, and support for low-carbon manufacturing.

What we got: A welcome decision on landfill tax, but no strategic movement on carbon.

There were no explicit commitments on whole life carbon reporting. The only relevant environmental policy shift came via the decision not to converge Landfill Tax rates, avoiding a steep rise in inert waste disposal costs. While the aims of the consultation were widely supported – tackling waste crime and improving tax integrity – the government recognised industry concerns about disproportionate cost impacts.

Beyond this, there were no new incentives or industrial support mechanisms targeting low-carbon construction products.

Source: BCIS Autumn Budget and the Built Environment webinar, 4 December 2025

Overall assessment

The Autumn Budget provided a few supportive measures – planning capacity, apprenticeship funding and restraint on landfill tax reform – but stopped short of delivering the substantive interventions needed to shift construction activity or reduce business costs in the near term.

For a sector expected to underpin economic growth, the Budget felt more like an exercise in stability than stimulation. With structural pressures on labour, materials, finance and standards continuing to build, confidence could depend heavily on future fiscal events and departmental spending plans.

Instead of holding off for uncertainty to lift, however, or postponing viability decisions in anticipation of each new fiscal announcement, many developers, investors and contractors may benefit from progressing plans pragmatically within current conditions. Steady, measured action now can help maintain momentum and leave organisations better positioned when confidence returns.

To keep up to date with the latest industry news and insights from BCIS register for our newsletter here.