The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 24/10/2025

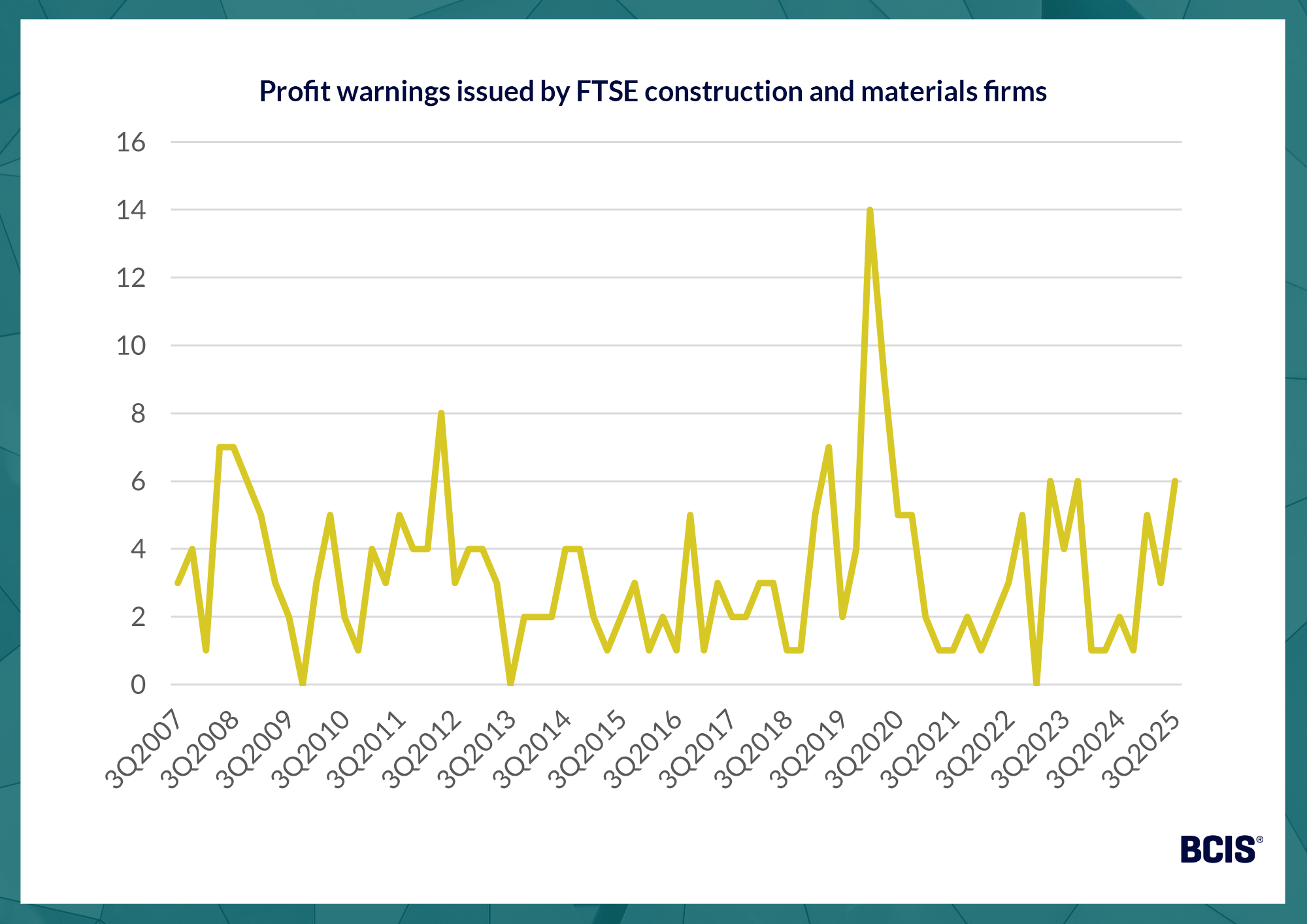

EY-Parthenon publishes its profit warnings report on a quarterly basis(1). The report outlines the profit warnings issued by companies from different sectors and provides an analysis of the factors driving the warnings issued.

Profit warnings are statements issued to the stock exchange by listed companies to declare that their full-year profits will be materially below management or market expectations.

Key takeaways from the latest profit warnings report

Profit warnings issued by FTSE construction and materials firms in 2025 to date are now nearly triple the level recorded in the whole of 2024, according to the latest profit warnings report from EY-Parthenon.

The report confirmed that six warnings were issued by businesses in the sector in 3Q2025, taking the total number for the year to 14.

This was the highest quarterly number recorded for the sector since 4Q2023 and the joint second highest total of all sectors in 3Q2025.

On a quarterly basis, the sector’s profit warnings increased by three on 2Q2025 and by four on the year and, akin to many businesses across the wider economy, were largely driven by the interaction of multiple headwinds at the same time.

The national outlook

On a national level, there were 64 profit warnings issued in 3Q2025 against a backdrop of continued geopolitical tensions and policy change.

This was a 24% fall on the year but an increase of five warnings on the quarter.

Almost one in five (18%) companies warned in the last 12 months – a level usually associated with recession or shock.

Source: EY-Parthenon analysis of UK profit warnings

Low consumer confidence was among the defining trends in the last quarter and was cited in 19% of warnings issued.

Continued inflation, slow growth and elusive policy clarity were further underlined for creating a complex economic environment and according to the report, nearly half of all profit warnings in the last six months have referenced geopolitical or policy uncertainty.

Looking ahead, the report highlighted the importance of business agility, scenario planning and execution in navigating further challenges and forecast that the combination of multiple headwinds will continue driving profit warning activity.

Construction profit warnings in context

Warnings issued by FTSE construction and materials firms in 3Q2025 were made against a backdrop of residential market weakness, commercial uncertainty, budget constraints, and delays caused by new safety regulations.

Source: EY-Parthenon analysis of UK profit warnings

The report stressed the role of these factors in eroding the sector’s recovery last year and revealed that more than 70% of profit warnings issued by FTSE construction and materials firms in 2025 have cited weaker confidence or delayed project starts and timelines.

Warnings are reportedly growing among the sector’s larger, mid-market companies with the average turnover of companies issuing warnings this year standing at just over £400 million – up from £300 million in 2024 and £200 million in 2023.

Employers’ National Insurance contributions (NICs) were also noted for driving cost pressures among FTSE construction and materials firms.

This was reflected in the wider commentary on the limited ability of labour-intensive consumer sectors to absorb rising employment costs amid slow demand.

Dr David Crosthwaite, chief economist at BCIS, said: ‘It’s a tricky time to be in construction. It’s well known the sector is largely made up of SMEs that can face a complex risk-transfer culture, wafer-thin margins and cash flow problems at the best of times.

‘However, what’s concerning from this latest report is the rise in larger firms issuing profit warnings. This suggests the economic and regulatory problems afflicting the sector are becoming more deeply rooted.’

Unlike other areas of the economy, construction is often disproportionately impacted by cost increases, usually due to fluctuations in demand uncertainty and materials prices.

EY’s latest Restructuring Pulse Survey(2), which draws insights from more than 200 workout banking professionals (who support firms experiencing financial difficulties) across 25 countries including the UK, showed that construction continues to face significant headwinds. Economic uncertainty, labour shortages and lingering cost pressures were all cited as key factors.

Restructuring activity includes any financial, structural or operational changes made by a business to improve efficiency, adapt to new needs or overcome financial challenges.

According to the survey, construction firms were among those with the most ‘expected’ restructuring activity for the first half of 2025. Promisingly, the survey reported that corporate restructuring activity in construction is expected to stabilise.

‘If the latest profit warnings reveal anything, it’s that waiting for external pressures to ease is fruitless’, Dr Crosthwaite added.

‘While the government has its work cut out to improve investment conditions in the Autumn Budget, construction businesses must carry on with business as usual and prioritise early risk planning and financial due diligence.

‘Collaboration between construction firms and their clients to set realistic programmes, establish fair risk allocation and manage project finances effectively is more necessary now than ever, and will ultimately benefit all parties.’

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.