The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 20/02/2026

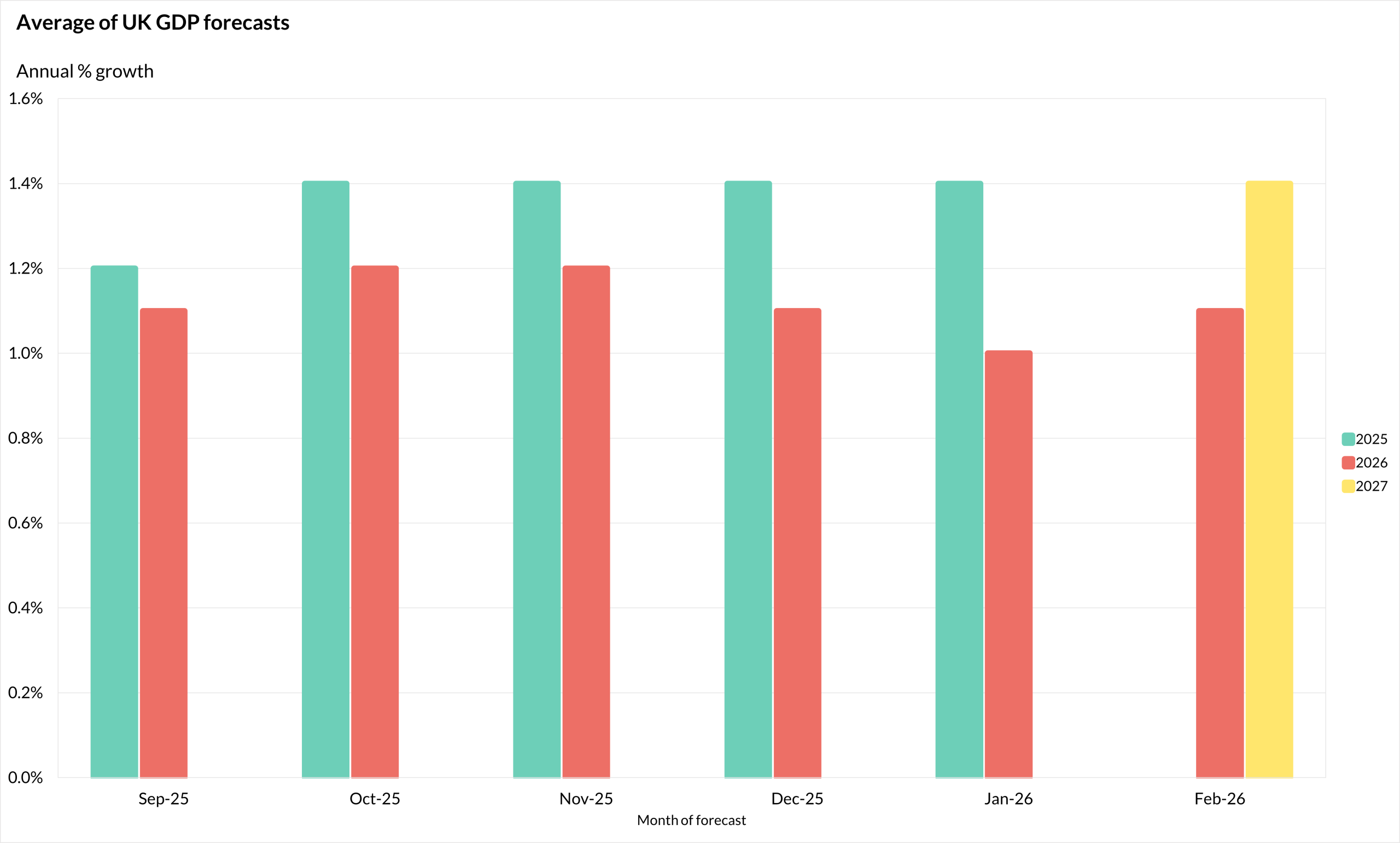

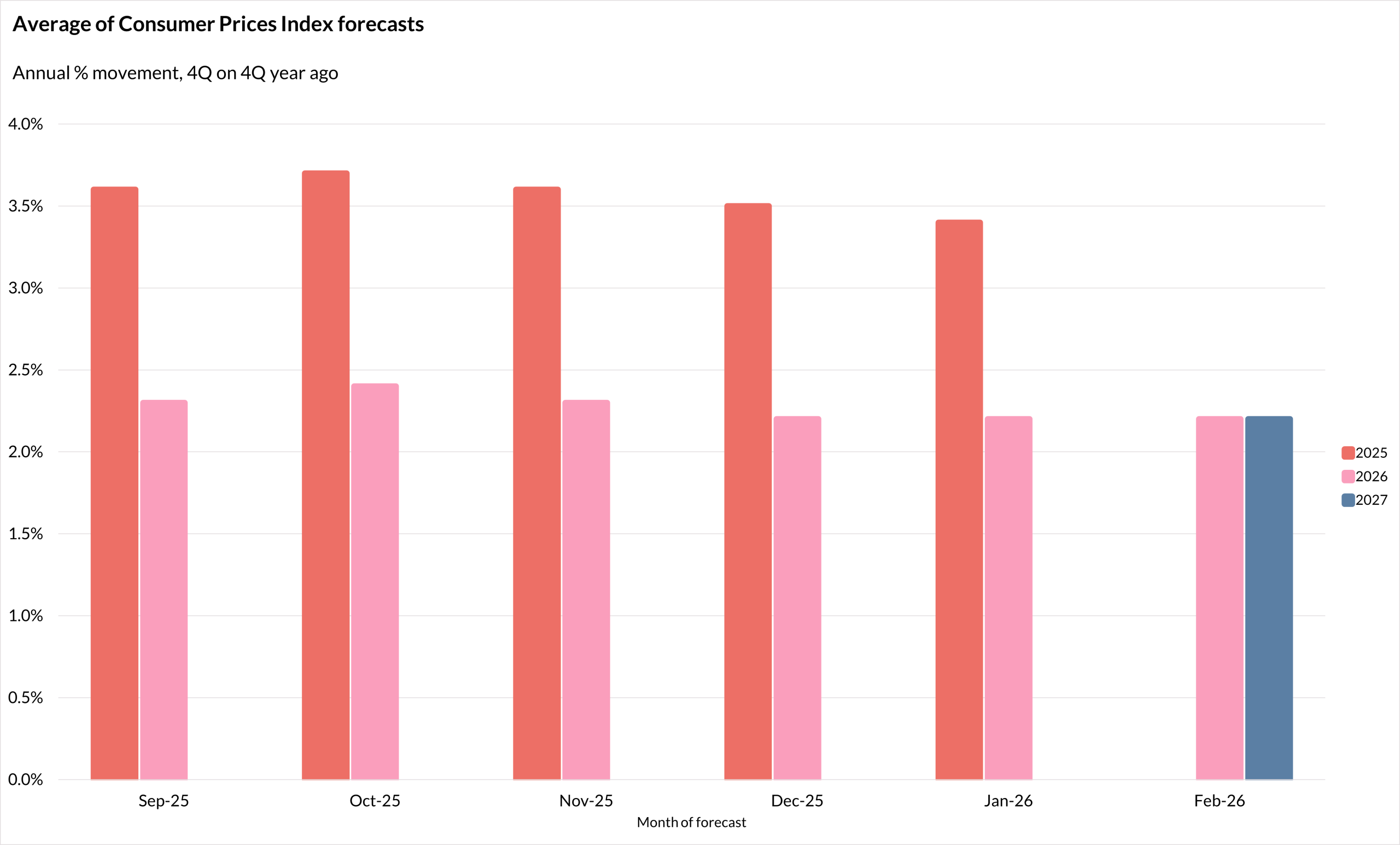

Each month HM Treasury publishes a comparison of independent forecasts for the UK economy, including averages for GDP growth and Consumer Prices Index (CPI) inflation. These forecasts are a useful barometer for construction, helping firms to understand the wider forces shaping demand, costs and investment decisions.

Growth predictions for UK economy ease slightly for 2026

Independent economic forecasts received by HM Treasury in February continue to point to modest UK economic growth in 2026(1).

The average of new independent forecasts points to UK GDP growth of 1.1% in 2026, moderating to 1.4% in 2027. By comparison, GDP growth averaged closer to 2% through much of the 2010s. Since the pandemic, growth has settled nearer to 1% per year, reflecting the UK’s weaker post-COVID recovery.

Source: HM Treasury – Forecasts for the UK economy: February 2026

The latest Office for National Statistics (ONS) estimates show that monthly GDP grew by 0.1% in December(2), following 0.2% growth in November, revised down since the last bulletin update. Construction output, however, declined by 0.5% in December.

Dr David Crosthwaite, chief economist at BCIS, said: ‘The latest Treasury forecasts, which include the first predictions for 2027, suggest GDP growth will pick up slightly in the coming year and inflation is predicted to fall closer to the Bank of England’s 2% target.

‘Things are moving in the right direction, but the slower pace of growth is still a concern and may continue to limit investment in construction.’

A relatively flat economic backdrop suggests developers, housebuilders and clients are likely to remain cautious about new investment.

Any recovery in workloads is therefore likely to be gradual and uneven across sectors, reinforcing the importance of careful forward planning and cost management.

The forecasts published by the Treasury also suggest CPI inflation will average 2.2% in 4Q2026, compared with 4Q2025, and maintain that level in 2027.

Source: HM Treasury – Forecasts for the UK economy: February 2026

Dr Crosthwaite said: ‘The expected easing of inflation is a positive for the construction industry, but it is one of multiple cost pressures weighing on supply and demand. It could support certain markets, such as residential, by improving household budgets, however subdued growth and high employment and business costs are far greater challenges in terms of stimulating output across the board.’

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.