If you are a housebuilder or developer, please fill in the survey. If you have any questions or would like to discuss the survey, please call +44 0330 341 1000 or email contactbcis@bcis.co.uk

Published: 20/02/2026

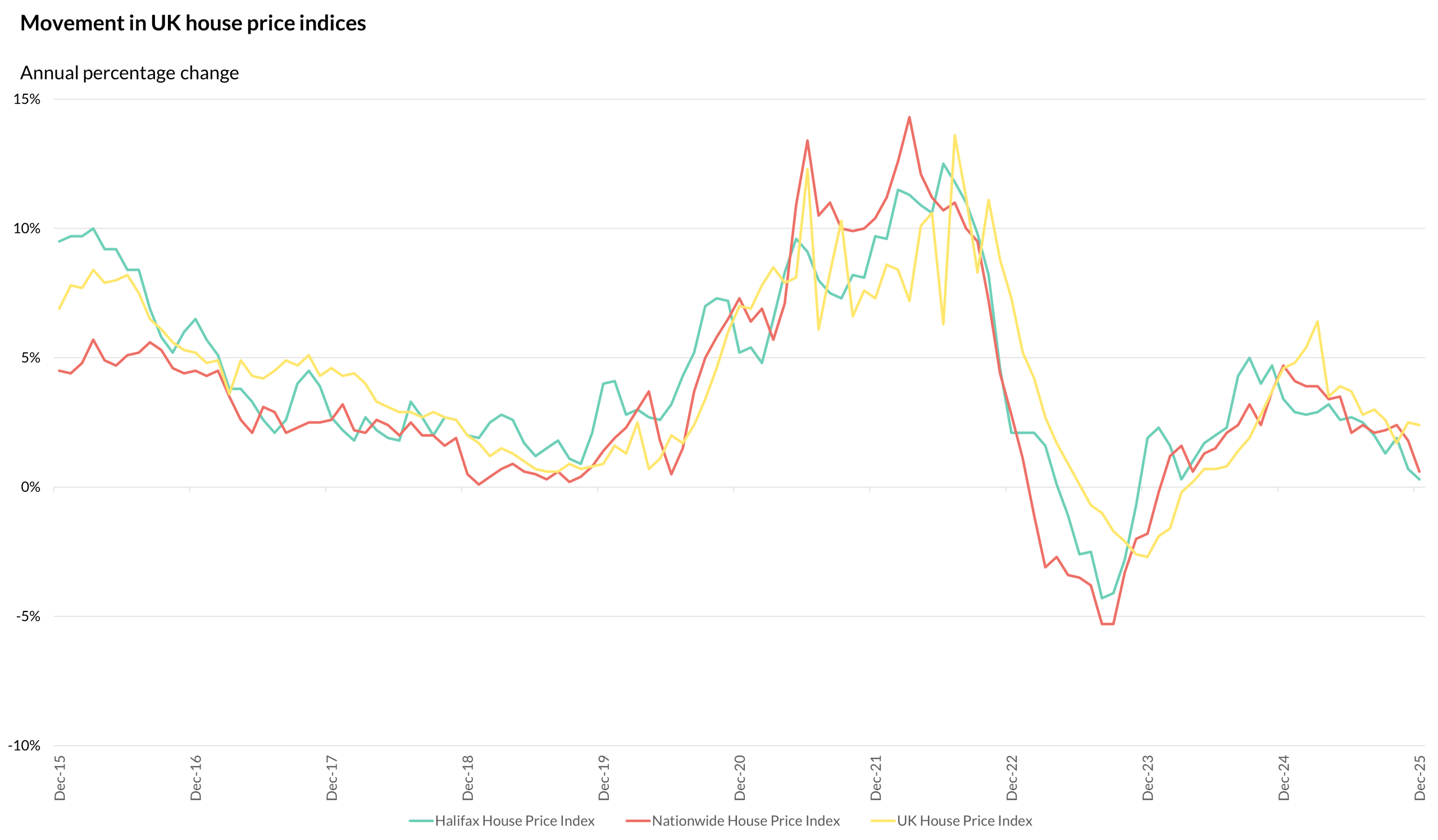

Each month, Halifax, Nationwide and HM Land Registry publish house price indices, tracking the movement in average house prices in the UK. Halifax and Nationwide updates are based on mortgage approvals data, while the UK HPI is a joint production by HM Land Registry, Land and Property Services Northern Ireland, ONS and Registers of Scotland.

House price growth sees uptick in January

House prices rose by 1.0% in the year to January 2026, according to Halifax(1) and Nationwide’s(2) indices.

On a monthly basis, Halifax reported a 0.7% increase in prices in January, while Nationwide reported a 0.3% rise.

Dr David Crosthwaite, chief economist at BCIS, said: ‘The latest house price indices point to a modest upturn in monthly house price growth at the start of 2026 after a dip in December. While it’s not certain whether consistent growth will hold in the coming months, any sign of improvement in affordability will be a welcome boost to residential developers in what remains a challenging market.’

According to the latest insight from the Financial Conduct Authority, which collects mortgage lending data via the Mortgage Lending and Administration Return(3), the value of new mortgage commitments (lending agreed to be advanced in the coming months) increased by 1.6% in 3Q2025 from the previous quarter – the highest since 3Q2022 and 20.3% higher than one year earlier.

Amanda Bryden, Head of Mortgages at Halifax, said that while the housing market entered 2026 on a steady footing, affordability is still a challenge for would-be buyers.

‘Broader economic conditions continue to provide some support. Wage growth has been outpacing property price inflation since late 2022, steadily improving underlying affordability. That’s a positive trend for buyers, and the long-term health of the market,’ she said.

Commenting further, Nationwide’s Chief Economist, Robert Gardner, said: ‘Housing market activity is likely to recover in the coming quarters, especially if the improving affordability trend seen last year is maintained.

‘Our main affordability benchmark shows that a prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 32% of their take-home pay – slightly above the long-run average of 30% and well below the recent high of 38% recorded in 2023.’

The UK HPI(4), with the latest data for December 2025, showed a 2.4% increase in house prices compared with December 2024, with a 0.7% decrease on November 2025.

As the UK HPI figures cover house sales that may have been agreed in months previously, there tends to be a lag in the data.

Source: Halifax (Methodology), Nationwide (Methodology), UK HPI (Methodology)

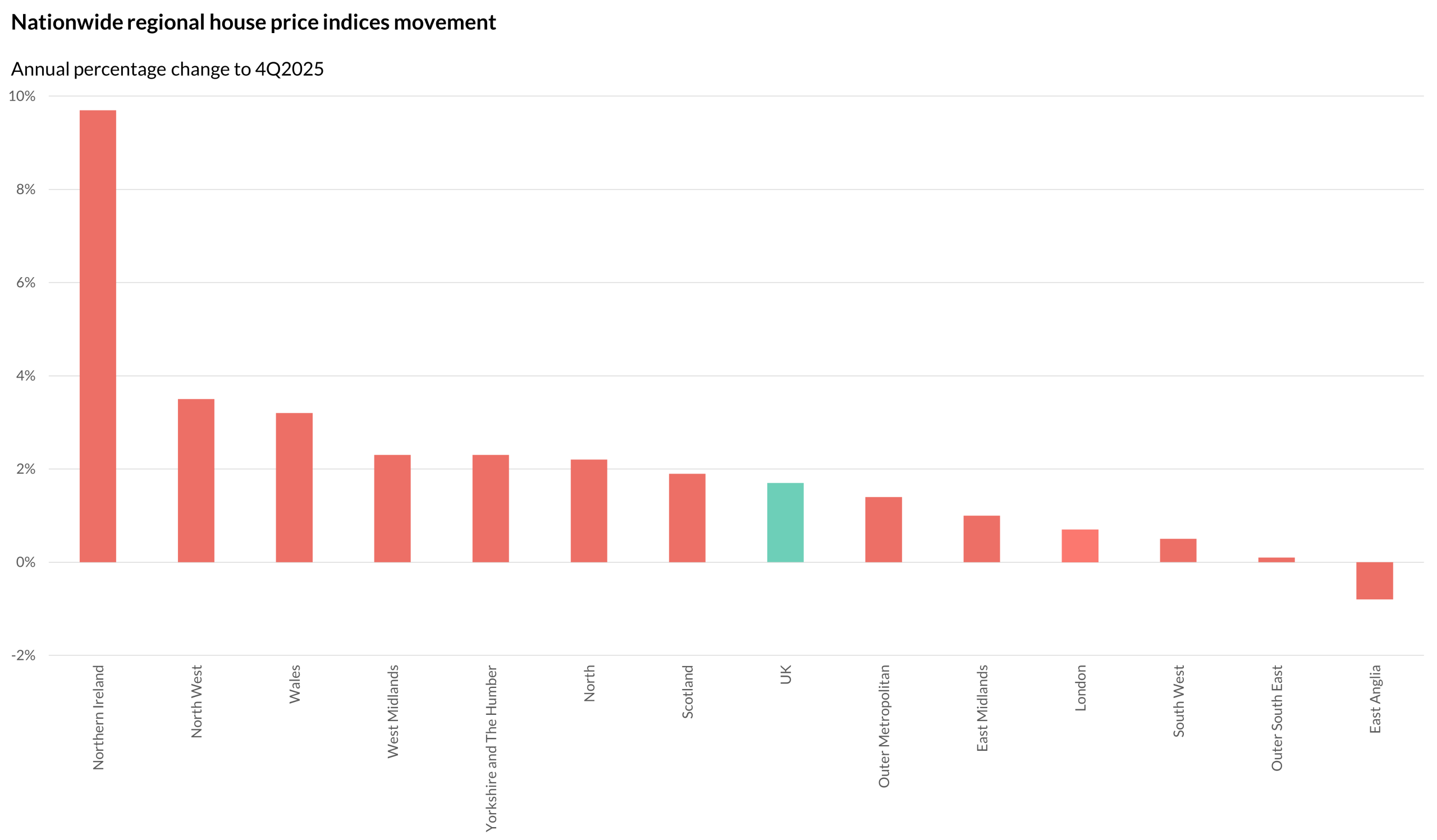

The latest regional data from Nationwide show Northern Ireland and the North West saw the greatest annual house price increases in 4Q2025, by 9.7% and 3.5% respectively.

East Anglia was the only region to experience a fall, of 0.8% on an annual basis.

In 4Q2025, the UK as a whole saw annual price growth of 1.7% on the same quarter in 2024.

Source: Nationwide – Quarterly Regional House Price Statistics – Q4 2025.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.