The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 01/10/2025

New insight from BCIS’s quarterly construction panels suggests the sector’s labour shortage is still an active concern for contractors, consultants and, increasingly, clients.

The shortfall is currently being priced into tenders, while some contractors are scaling back recruitment. Official data indicates the construction workforce is much smaller than the level seen 20 years ago and there’s a risk that shortages for specific trades could be exposed and exacerbated by an increase in demand.

For now, the extent to which construction firms can weather the cost risks thrown up by labour shortages largely comes down to pipeline visibility and due diligence.

Construction’s labour shortage is well-documented but the latest data from the Office for National Statistics (ONS) stirs up more questions than answers about how skills gaps are playing out.

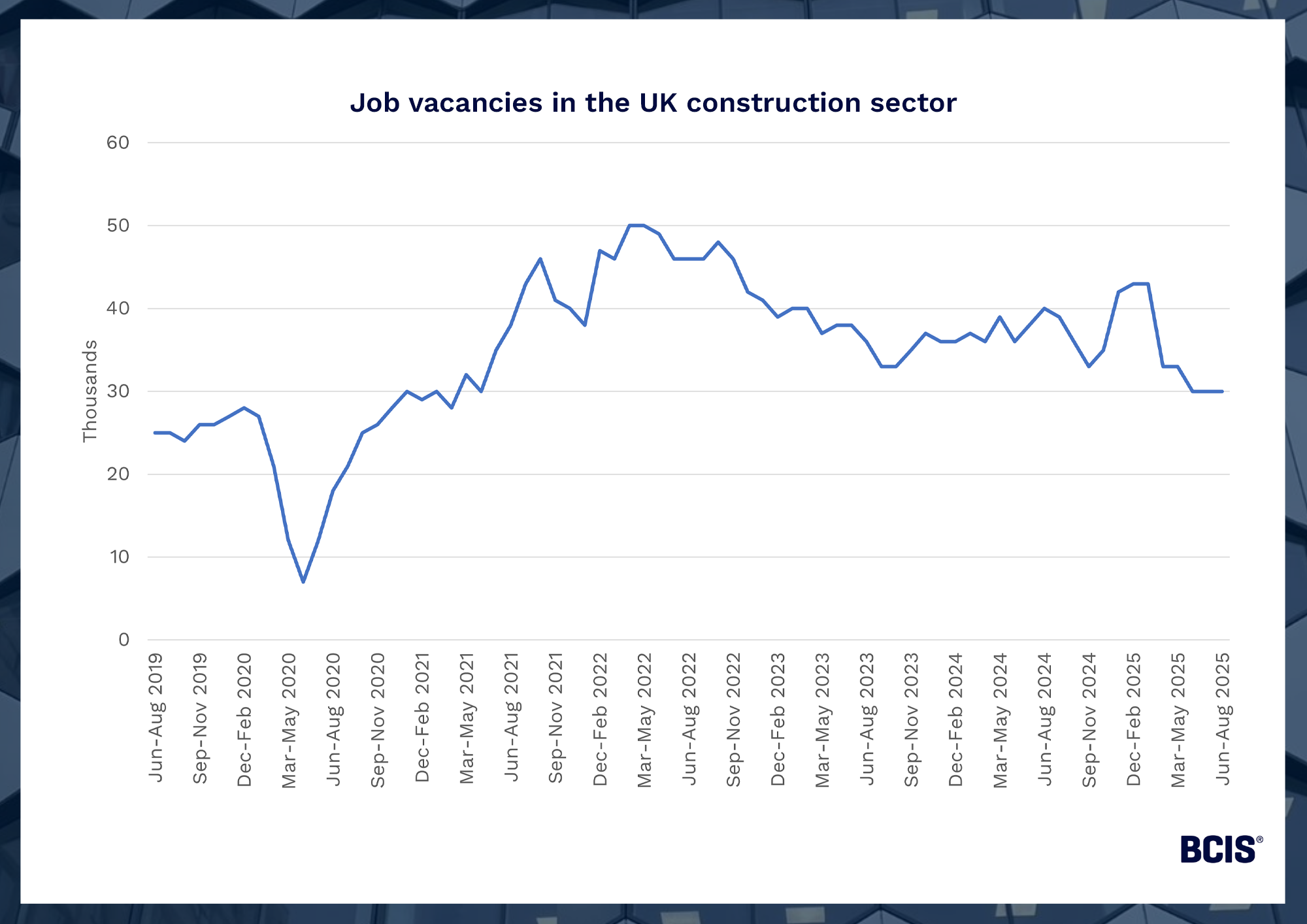

For example, new data show that the sector’s job vacancies are relatively low, standing at 30,000 between June and August 2025(1) – 25% less than the number recorded for the same period in 2024.

This reflects a downward trend in the wider UK jobs market and suggests high employment costs and uncertainty around the upcoming Autumn Budget are discouraging recruitment as much as a cooling in construction demand.

Source: ONS – VACS02 – Vacancies by industry

However, it’s not clear whether low vacancies are also a signal of demand for specialised labour (i.e. the only jobs on the market are those targeting a specific worker demographic).

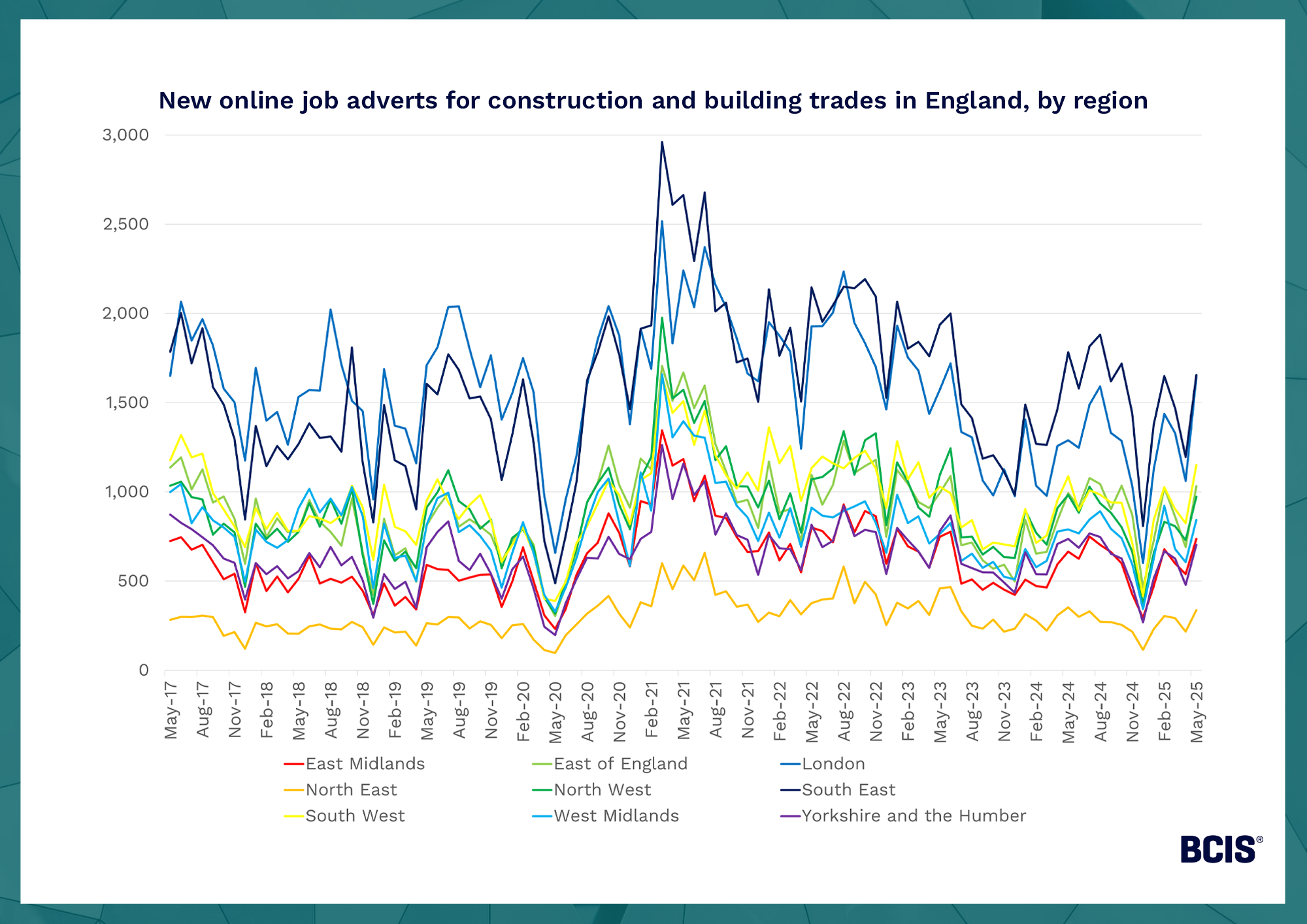

We know from job adverts data for specific trades that higher levels of work can spike demand for certain skills.

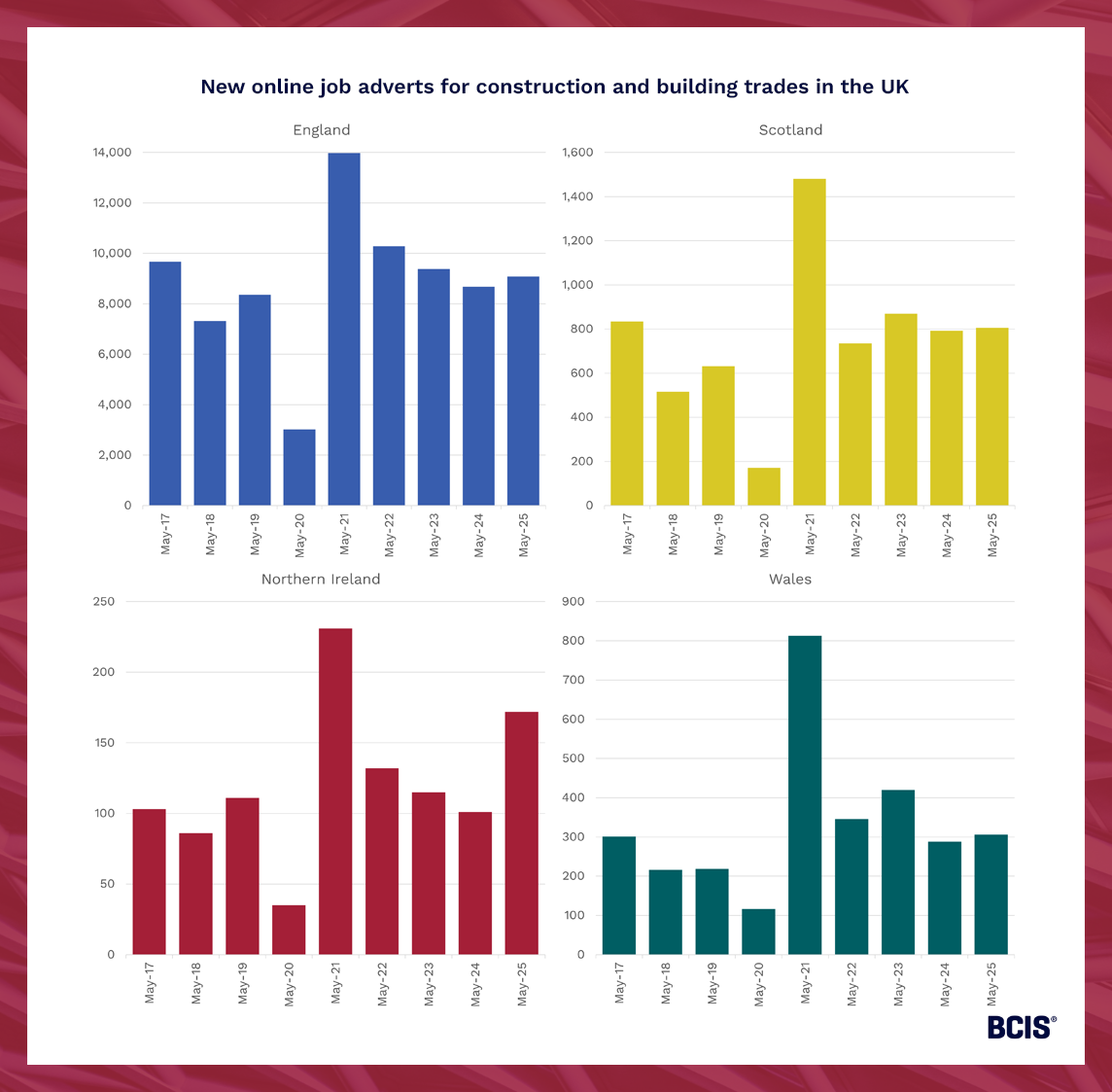

For instance, trends in new online job adverts for construction and building trades (a standard occupation classification including bricklayers, roofers and carpenters and joiners) show significant spikes around April 2021 after the pandemic lockdowns subsided(2).

Source: ONS – Labour demand volumes by Standard Occupation Classification (2020SOC), UK

This seems to correlate with the spikes in construction output around the same time and reflects reactive recruitment patterns in construction where employers subcontract workers for short periods over hiring full-time labour.

While this is fairly standard, there’s a risk that in times where new work increases suddenly – which may happen once the Planning and Infrastructure Bill is approved and/or investment picks up – demand for certain trades will spike and have an inflationary effect on labour costs and tender prices.

The regional distribution of labour may compound this issue at a local level.

In England, there have been consistently more adverts for construction and building trades in London and the South East. The same can be said for England as a whole when compared with the other UK nations.

Source: ONS – Labour demand volumes by Standard Occupation Classification (2020SOC), UK

This likely reflects the higher concentration of work in London and the south and highlights the potential for demand pick-up to intensify local skills gaps.

Local worker shortages can broadly lead to higher prices in the given areas and even squeeze smaller businesses out of work if they cannot source or afford labour, although construction labour does tend to be more mobile – at a price.

While it’s hard to pinpoint the true extent of skills shortages, long-term trends in the number of employed and self-employed workers in construction underline the need for a bigger workforce generally.

According to the latest version of the ONS dataset EMP14(3), which measures the average number of employed and self-employed people working in construction each quarter, the sector’s workforce reached its lowest level in one year in 2Q2025 and had shrunk by 12% on pre-pandemic 2Q2019.

That said, construction output remained steady in the same period, implying that productivity has counteracted any effects of a smaller workforce.

A forward-looking intelligence report from the Construction Industry Training Board (CITB) estimates that an additional 47,860 workers will be needed per year for the 2025-2029 period to replace people retiring or leaving the sector(4).

The government’s strategy is to train 100,000 construction workers per year by 2029 – a welcome and positive solution but one that risks putting all eggs in one basket.

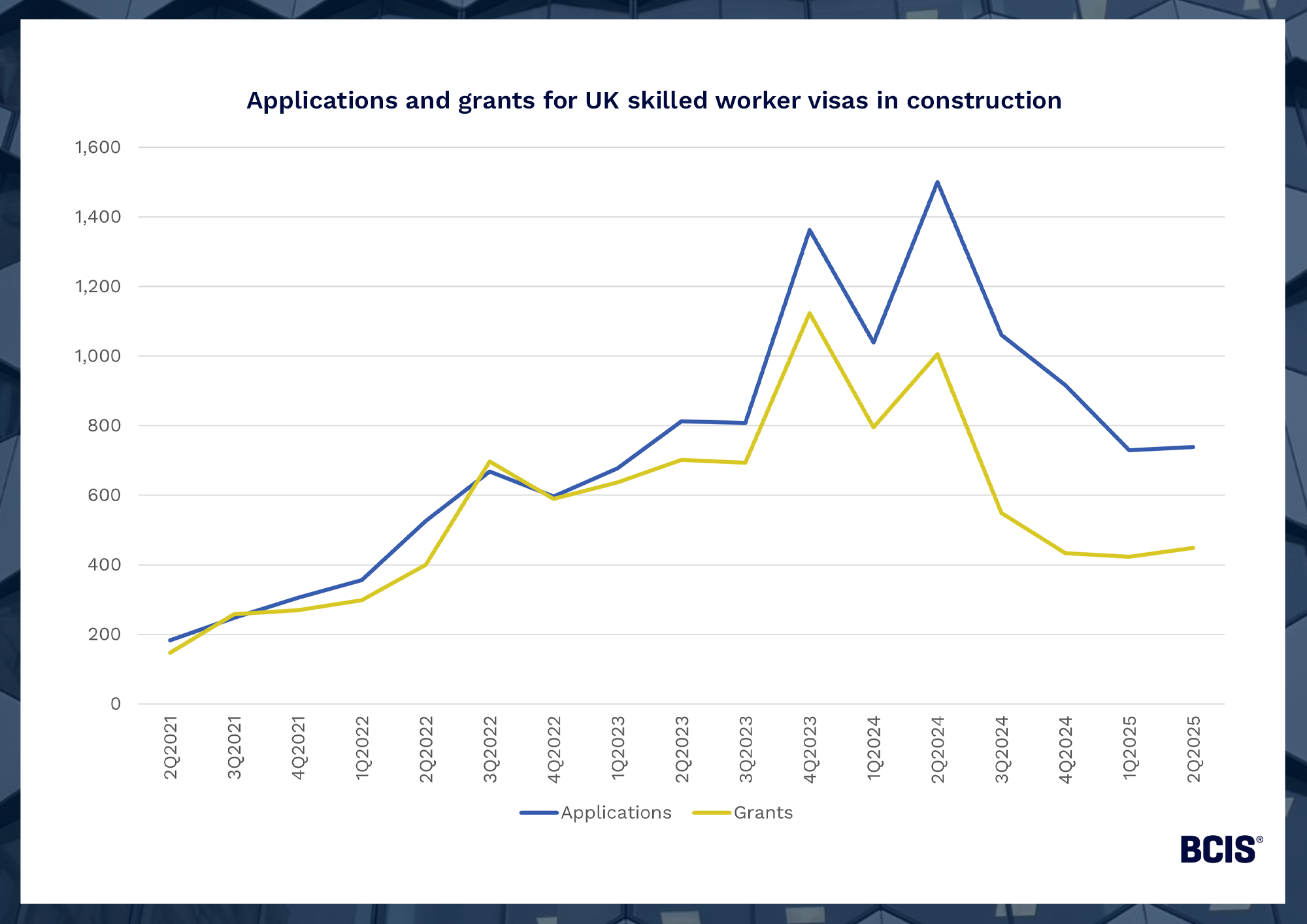

The UK has historically relied on overseas labour to meet demand but post-Brexit, and amid the government’s immigration reforms (which include raising the qualification threshold for workers entering on skilled worker visas in July 2025), this option is far less viable.

Readily available data from the Home Office show that in the two years ending in 2Q2025, more than 12,500 skilled worker visa applications were submitted for work in the UK construction sector(5).

Source: Home Office – Sponsored work entry clearance visas by occupation and industry (SOC 2020)

Applications made for these visas dropped off considerably after the peak seen in mid-2024. In 2Q2025, there were 761 (51%) fewer applications made than in the same quarter the year before.

The longer-term fall in overseas labour, particularly since Brexit, may have even played a part in the record number of visa rule-breaking cases in the year ending in June 2025(6).

So, what’s the answer to the labour shortage, and how can businesses adapt to the associated cost risks?

In short, addressing the labour crisis comes down to matching the right skills with the upcoming pipeline of work. This helps to reduce bottlenecks, potential wage inflation and wasted training investment.

The government’s training focus on in-demand trades such as bricklayers and electricians, combined with the varied geographical spread of Technical Excellence Colleges, should help to reinforce both national and local supplies.

However, training isn’t a quick process and what businesses really need in the near-term is pipeline visibility.

Insight from multiple BCIS panels has revealed that the lack of visibility over upcoming work continues to be a major issue across the board. This is making it hard to predict project timings and, in the context of the labour shortage, muddies the ability to capacity plan with certainty.

Currently, many construction businesses rely on subcontractors as their use can be adjusted with demand levels.

For larger businesses, increasing direct employment and providing more training are obvious interim solutions but firms need guarantees about upcoming projects to make these investments worthwhile.

The best firms can aim for right now is due diligence; continuing to account for labour risks in tender pricing by using credible cost indices alongside early risk management and maintaining a robust cash flow.

BCIS forecasts output growth to pick up in 2026 and with the wheels turning on several major infrastructure projects, there’s hope for clearer skies ahead.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) Office for National Statistics – Vacancies and jobs in the UK: September 2025 – here

(2) Office for National Statistics – Labour demand volumes by Standard Occupation Classification (SOC 2020), UK – here

(3) Office for National Statistics – EMP14: Employees and self-employed by industry – here

(4) CITB – Construction Workforce Outlook – here

(5) GOV.UK – Immigration system statistics data tables – here

(6) GOV.UK – Record numbers of visa sponsor licences revoked for rule breaking – here