The Building Cost Information Service (BCIS) is the leading provider of cost and carbon data to the UK built environment. Over 4,000 subscribing consultants, clients and contractors use BCIS products to control costs, manage budgets, mitigate risk and improve project performance. If you would like to speak with the team call us +44 0330 341 1000, email contactbcis@bcis.co.uk or fill in our demonstration form

Published: 21/01/2026

Six years on from the onset of the pandemic, construction is still grappling with a hesitancy hangover.

Inflation has eased, but macroeconomic and geopolitical pressures linger and continue to squeeze budgets and margins, dissuading contractors from taking on a greater share of risk in the tendering process, even at the expense of cash flow.

Current reluctance toward large, complex projects and the preference for slightly safer procurement routes are in part a learned response to the high inflation of 2021 and 2022.

The pandemic was an unprecedented economic shock that disrupted supply chains and exerted significant upward pressure on construction costs.

Between September 2021 and October 2022, annual inflation in the BCIS General Building Cost Index – which tracks combined labour, plant and materials costs – was consistently above 10%, far higher than the regular level of movement. Inflation in the index peaked at 15.5% in June 2022.

Highly inflated construction costs put immense financial strain on contractors’ margins, particularly those working to fixed-price contracts, and was a significant contributing factor in the collapse of Buckingham Group and ISG in 2023 and 2024 respectively.

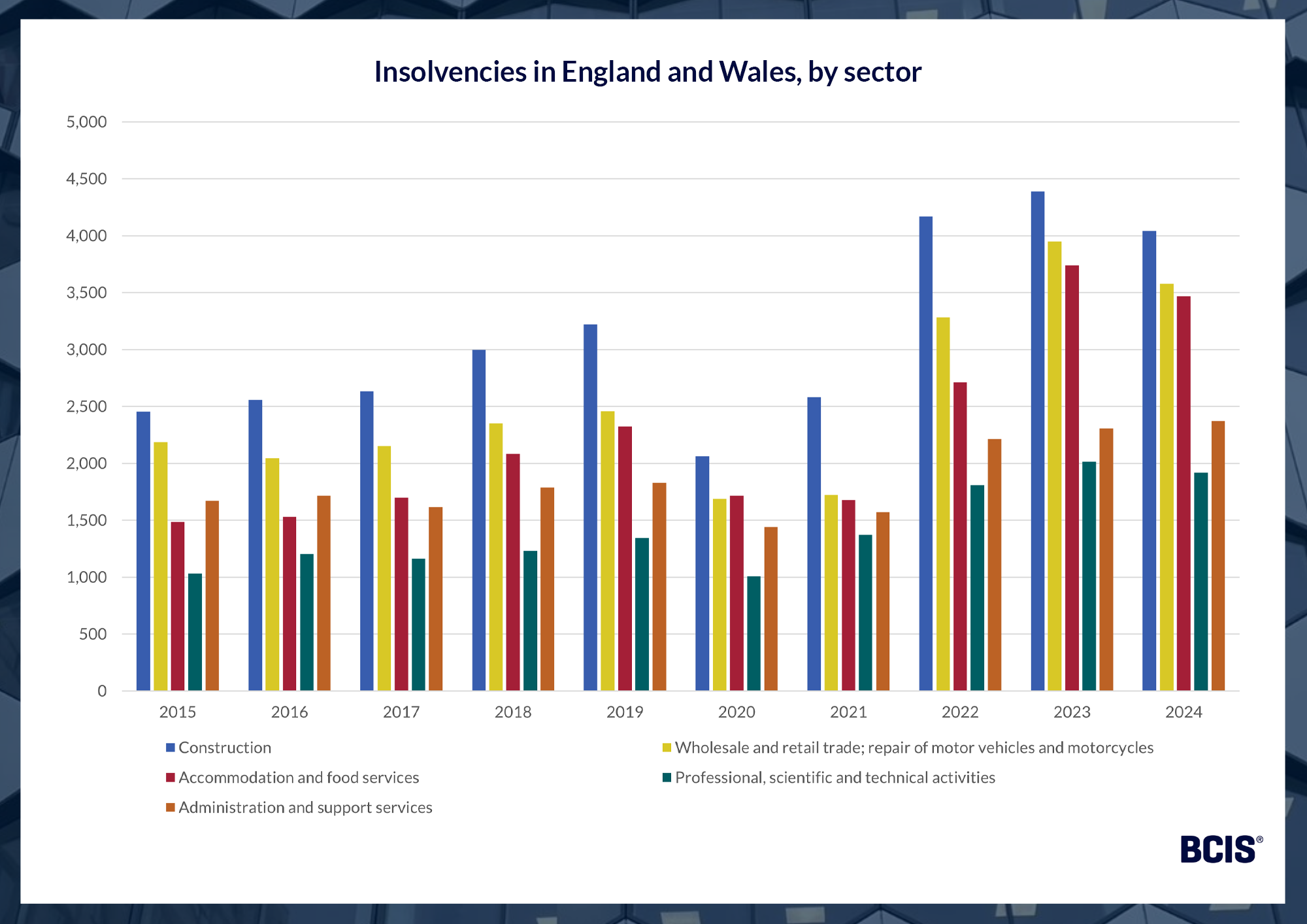

Data from The Insolvency Service demonstrates the impact of high inflation on supply chain insolvencies.

Source: The Insolvency Service

A total of 4,169 registered construction businesses became insolvent in 2022, rising to 4,389 the following year, far higher than the annual average (2,698) seen in the five years preceding 2022.

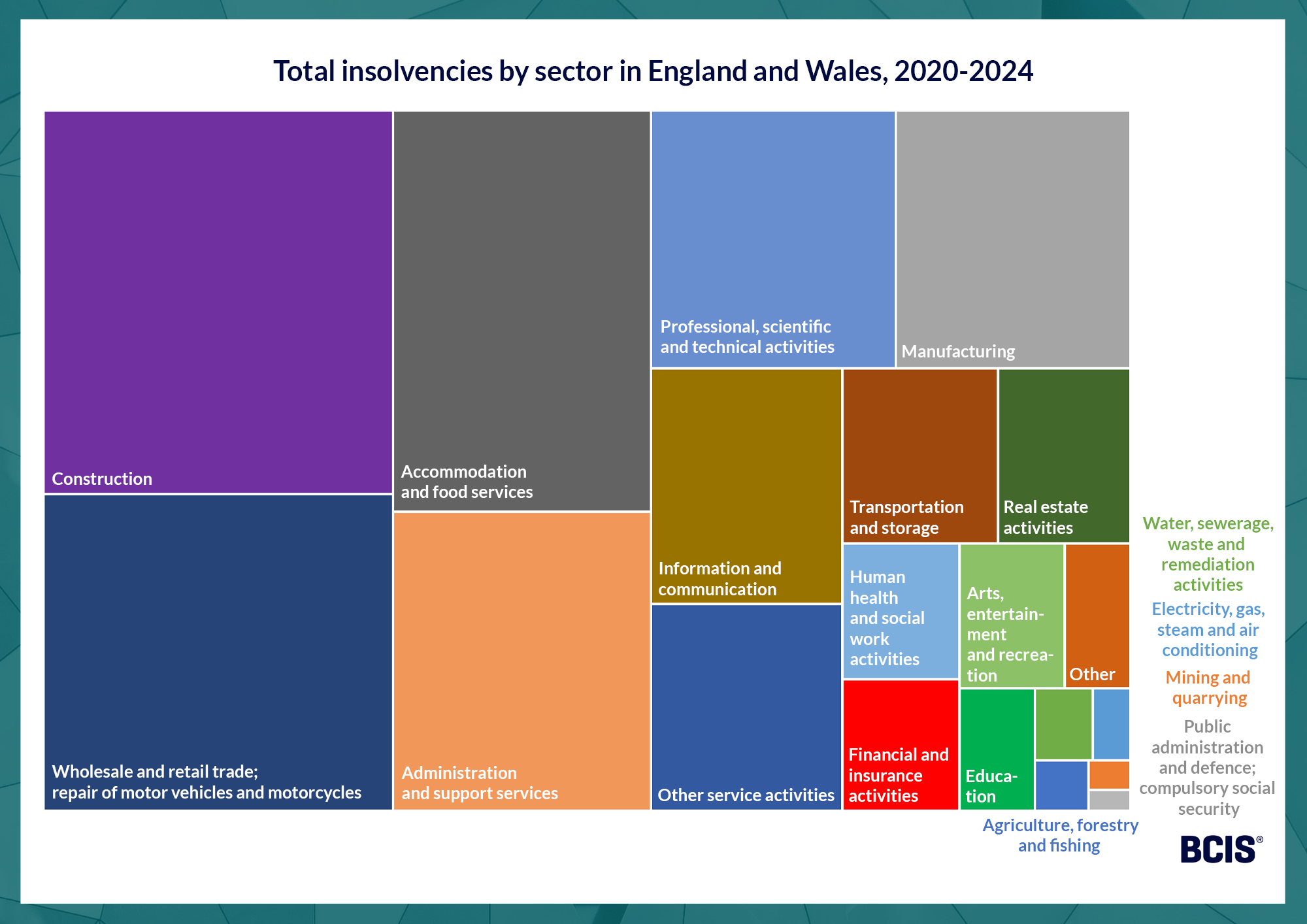

This took construction’s total insolvencies between 2020 and 2024 to 17,242 – over 3,000 more than wholesale and retail trade and the repair of motor vehicles and motorcycles, the sector with the second highest insolvency count for that period.

Even now, construction’s insolvencies remain considerably higher than pre-pandemic levels. The latest data for 2025, which runs to October, reported 3,359 insolvencies for last year with two months’ data still to be published.

Construction is certainly not on its own – other sectors including wholesale and retail trade and hospitality are at the mercy of reduced spending and investment in an economy hampered by trade tensions, business uncertainty and elevated interest rates.

Source: The Insolvency Service

Yet what makes construction’s vulnerability to insolvencies so singular is the co-existence of its fragmented and complex supply chains, delayed payment cycles and inherent makeup as a response to levels of investment.

It’s a combination that, in a low-growth economy where clients and investors are more hesitant, often leaves construction businesses exposed when larger contractors are forced to delay or pull the plug on work, or worse, enter administration.

A progress report from EY-Parthenon(1), published in October last year, estimated that ISG owes in the region of £885 million to unsecured creditors.

Construction News(2) has since shared insight from liquidators at Azets that this figure could be closer to £1.2 billion.

Coupled with several months of back-to-back reports of meagre output data and low confidence, it’s unsurprising risk aversion is so common.

Many in construction have adopted a ‘wait-and-see’ attitude in the hope conditions will improve and allow for a less tentative approach to procurement.

In the meantime, risk aversion continues to steer suppliers away from less secure procurement methods, such as single-stage design and build.

This has largely fallen out of favour, with the exception of simple commercial works or small fit-out projects, because contractors often face race-to-the-bottom bidding, lowering pricing to the point of little to no profit.

While it’s difficult to estimate how long a higher degree of risk aversion will prevail, reductions in the Office for Budget Responsibility’s growth predictions for the next five years suggest the full post-pandemic recovery of the economy is not due soon.

Until then, contractors will likely tread with extra care.

Mitigation measures that share the risk of inflation between client and contractor are fairly standard practice for most construction projects but appear heightened in current times.

For example, according to insight from the BCIS Tender Price Index (TPI) Panel, contractors are undertaking advance procurement and bulk buying to lock in prices.

Contingency is also being built into budgets as a volatility buffer and there’s continued use of collaborative contracts. For instance, target cost contracts with an activity schedule (i.e. New Engineering Contracts) where the client and contractor share out-turn financial risks at an agreed proportion.

Reflecting panel views, BCIS polling of construction professionals (the majority cost consultants and surveyors) in January 2026 suggested provisional sums and open book rates were the most common risk-sharing mechanisms in projects from the last 12 months.

Interestingly, polling also suggested that risk-sharing between client and contractor is limited.

34% of 357 respondents said the risk of inflation had been shared on very few projects they had been involved with in the past year. Just 4% reported risk-sharing on all projects.

In a market where both clients and contractors are risk averse, these results are to be expected.

Whether risk aversion endures will ultimately depend on the pace of economic reform, the return of sustained investment and the industry’s ability to rebuild confidence after a prolonged period of instability.

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.