BCIS CapX provides a comprehensive, detailed and easy-to-use method of measuring cost movement for building and civil engineering. Widely used in the construction and infrastructure sector to help fairly allocate risk between the client and sub-contractors.

Published: 06/02/2026

Each month the Department for Business and Trade (DBT) publishes construction material price indices, categorised under All Work, New Housing, Other New Work and Repair and Maintenance, as well as tracking a selection of building materials and components for the UK, and providing statistics on bricks and concrete blocks production, deliveries and stock for Great Britain (1).

BCIS data is used in the compilation of the DBT indices and the full methodology can be found here.

Publication of DBT’s construction material price indices (CMPIs) resumed in January 2026 after a pause between February 2025 and December 2025. This was due to a methodological error being identified and corrected by the ONS in its Producer Price Indices (PPIs) and Services Producer Price Indices (SPPIs).

Annual construction material prices more than double in 20 years

Based on an annual average, construction material prices for All Work in 2025 were more than double what they were two decades ago in 2005, according to the latest provisional data published by the Department for Business and Trade (DBT).

Prices for All Work in 2025 were also 39.0% higher than in pre-pandemic 2019 and 1.7% higher than in 2024.

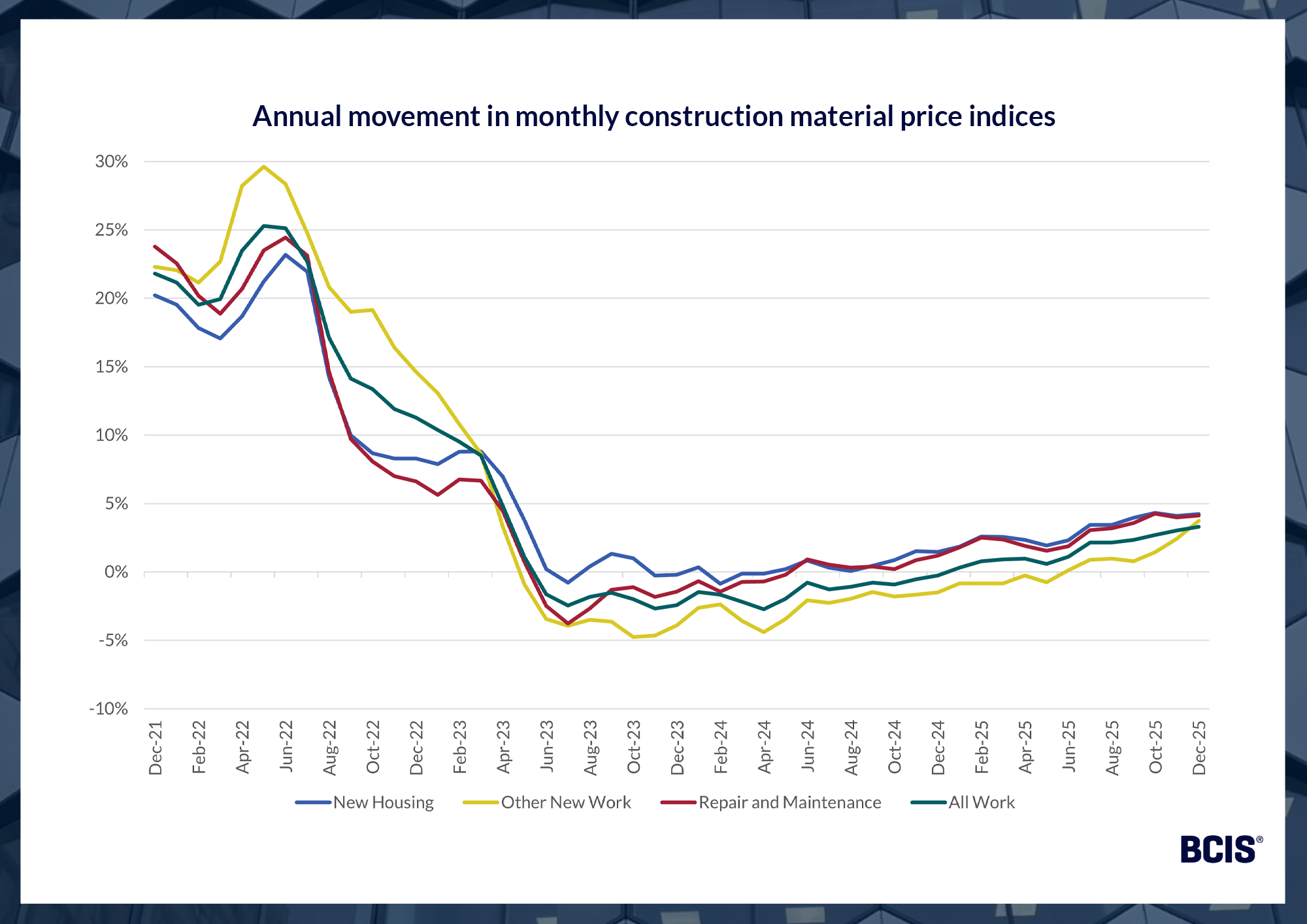

On an annual basis, construction material prices for All Work rose by 3.3% in the 12 months to December 2025.

This was the 12th consecutive month this index showed increasing annual movement and followed an 18-month period of decreasing annual movement between June 2023 and December 2024.

New Housing recorded a 4.2% increase, Other New Work rose by 3.7%, and Repair and Maintenance increased by 4.1% when comparing December 2025 with December 2024.

Source: Department for Business & Trade – Building materials and components statistics, Table 1a

Dr David Crosthwaite, chief economist at BCIS, said: ‘Steady growth in DBT’s material price indices could indicate a return of demand or more likely that suppliers have increased their prices. The slowdown in some building material sales and deliveries suggests the latter is certainly a contributing factor.

‘It’s a fallout from muted construction demand – less work forces suppliers to raise their prices to keep things ticking over. This means higher resource costs for contractors and added affordability pressure for clients as a result.’

Looking at the annual average of DBT’s producer price indices (PPIs) for individual resources, provisional data for 2025 show that prices for insulating materials (thermal or acoustic) have risen the most of all resources in the four years since 2021, when DBT PPIs start.

This was closely followed by prices for pre-cast concrete products with a 51.0% increase and screws with a 50.3% rise.

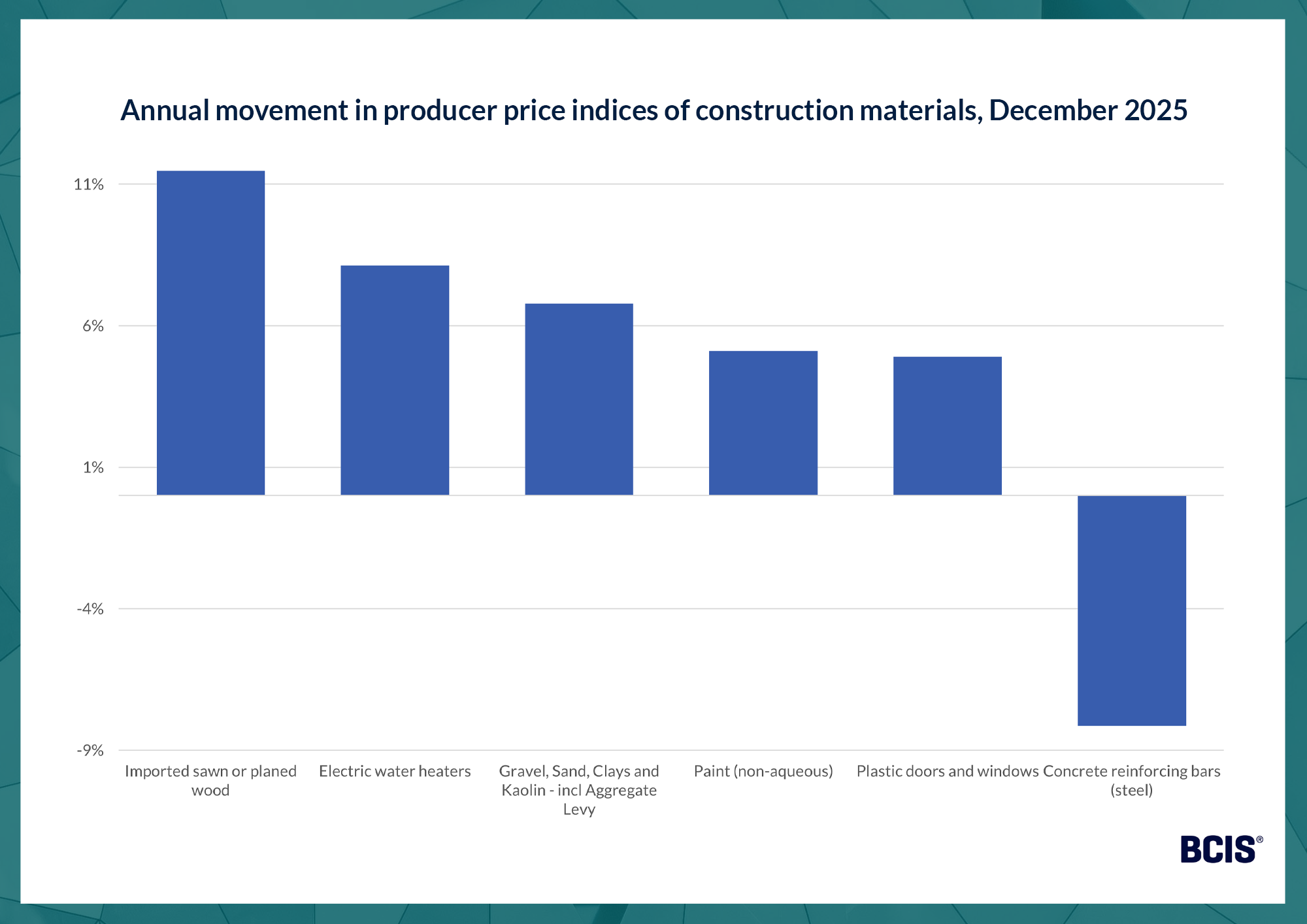

On an annual basis, imported sawn or planed wood prices saw the greatest inflation in the 12 months to December 2025, up by 11.5%. This was followed by an 8.1% rise in electric water heater prices.

Prices for concrete reinforcing bars (steel) saw the biggest annual decrease of all resources measured with an 8.1% fall.

Source: Department for Business & Trade – Building materials and components statistics, Table 2

*DBT advises index values should not be relied upon for long-term contractual purposes, as they are based on relatively few quotes.

On the month, gravel, sand, clays and kaolin (inc Aggregate Levy) experienced the greatest increase in annual price movement at 4.0%.

The steepest decrease was recorded for concrete reinforcing bars (steel) with a 1.3% fall.

Brick and block stocks high as ready-mixed concrete deliveries hit record low

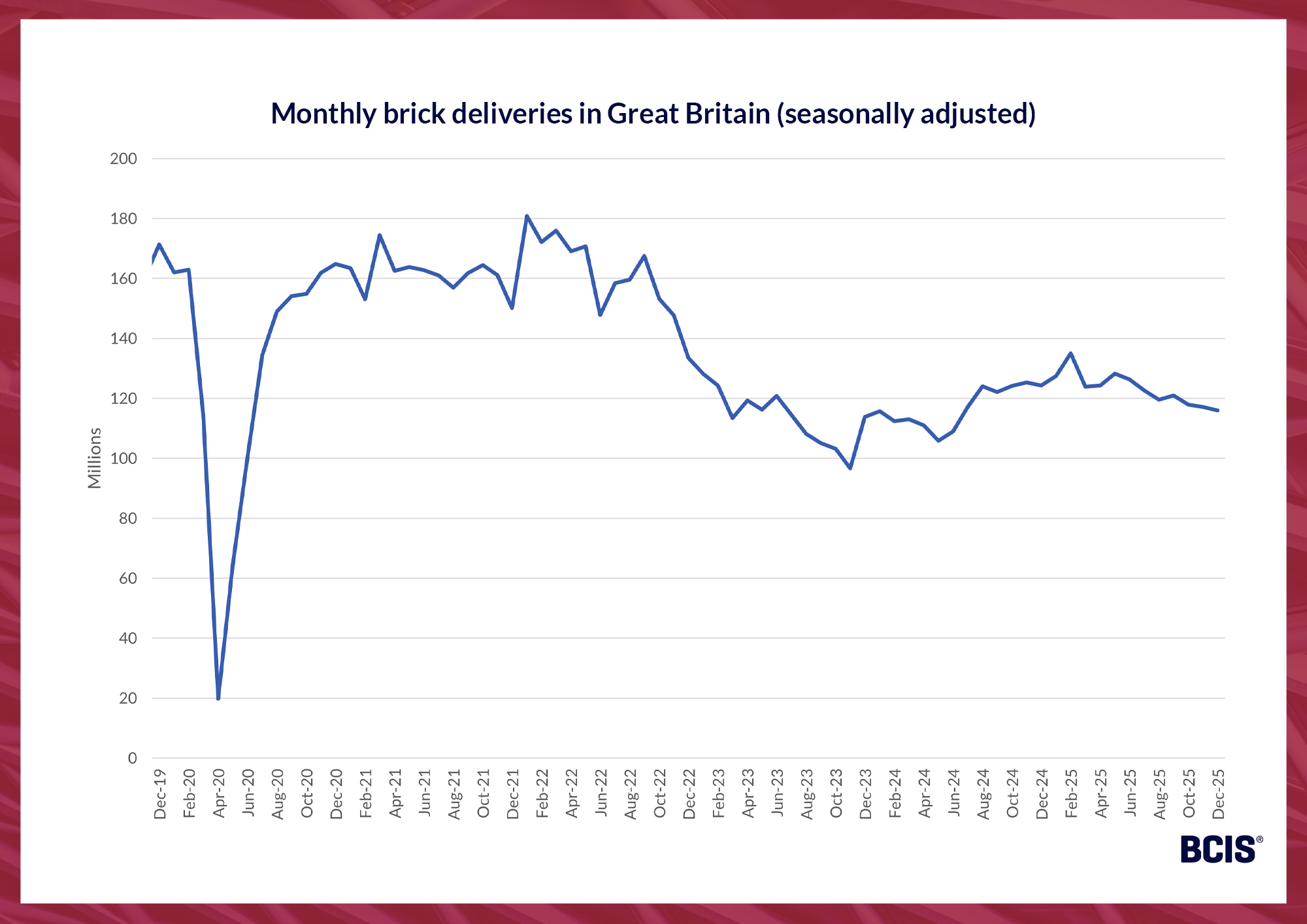

Brick deliveries (seasonally adjusted) in Great Britain decreased by 6.7% in the 12 months to December 2025 and were down by 1.0% compared with the previous month.

Against pre-pandemic lockdown activity levels, seasonally adjusted brick deliveries in December 2025 were 32.3% lower than in December 2019.

Stocks of all types of bricks at the end of December stood at 558.3 million, the highest level recorded since December 2023.

By comparison, brick stocks at the end of December 2025 were up by 16.1% on the end of December 2024 (481.1 million) and by 31.6% on the level in December 2019 (424.4 million).

Source: Department for Business & Trade – Building materials and components statistics, Table 9a

DBT’s report also showed concrete block deliveries (seasonally adjusted) in Great Britain were down by 17.3% in the year to December 2025 and by 2.1% on a monthly basis. They were down by 25.6% on December 2019.

Total stocks of concrete blocks stood at 8.8 million square metres’ worth at the end of December, an increase of 34.1% on December 2024.

This was the highest level recorded since March 2024.

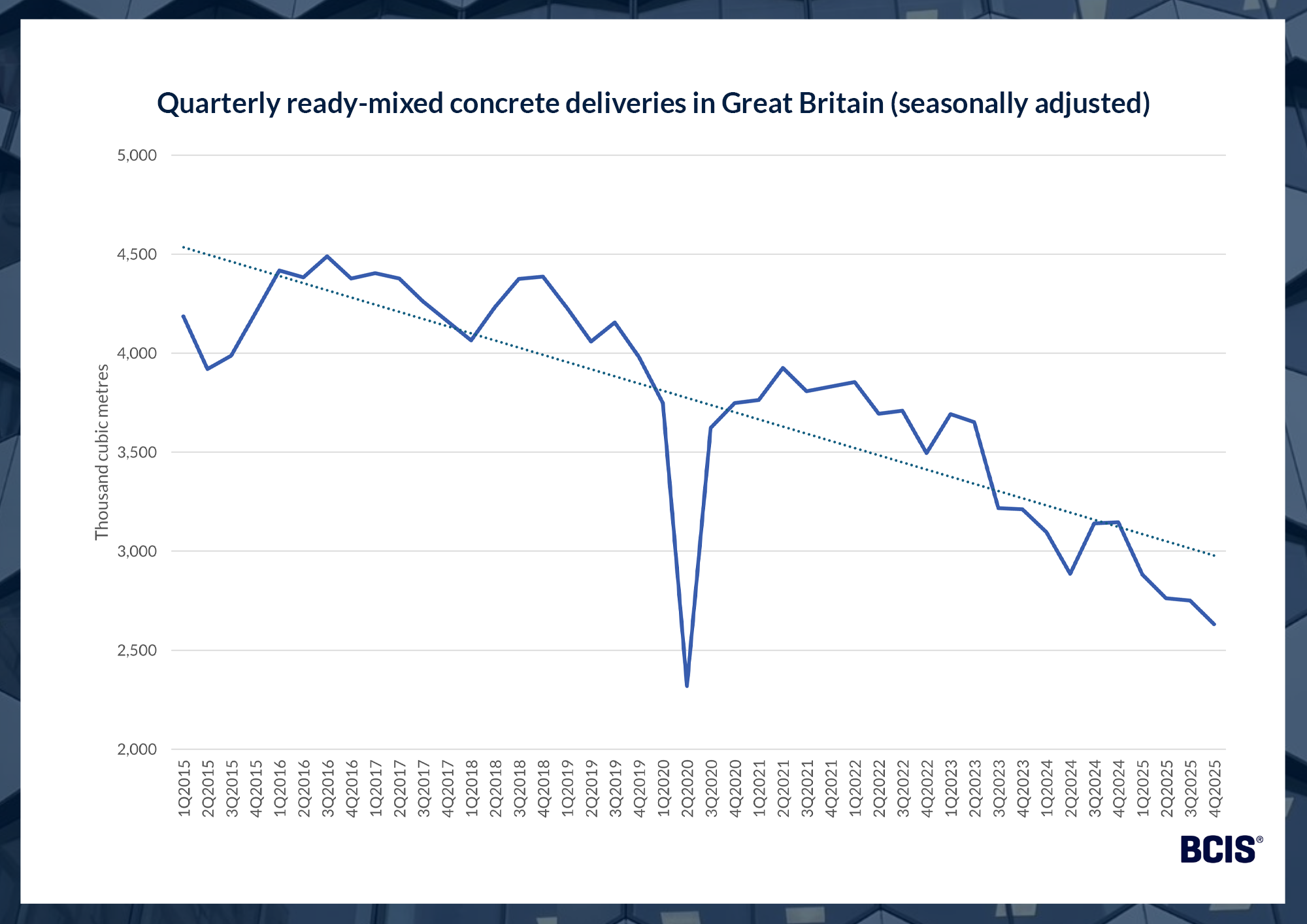

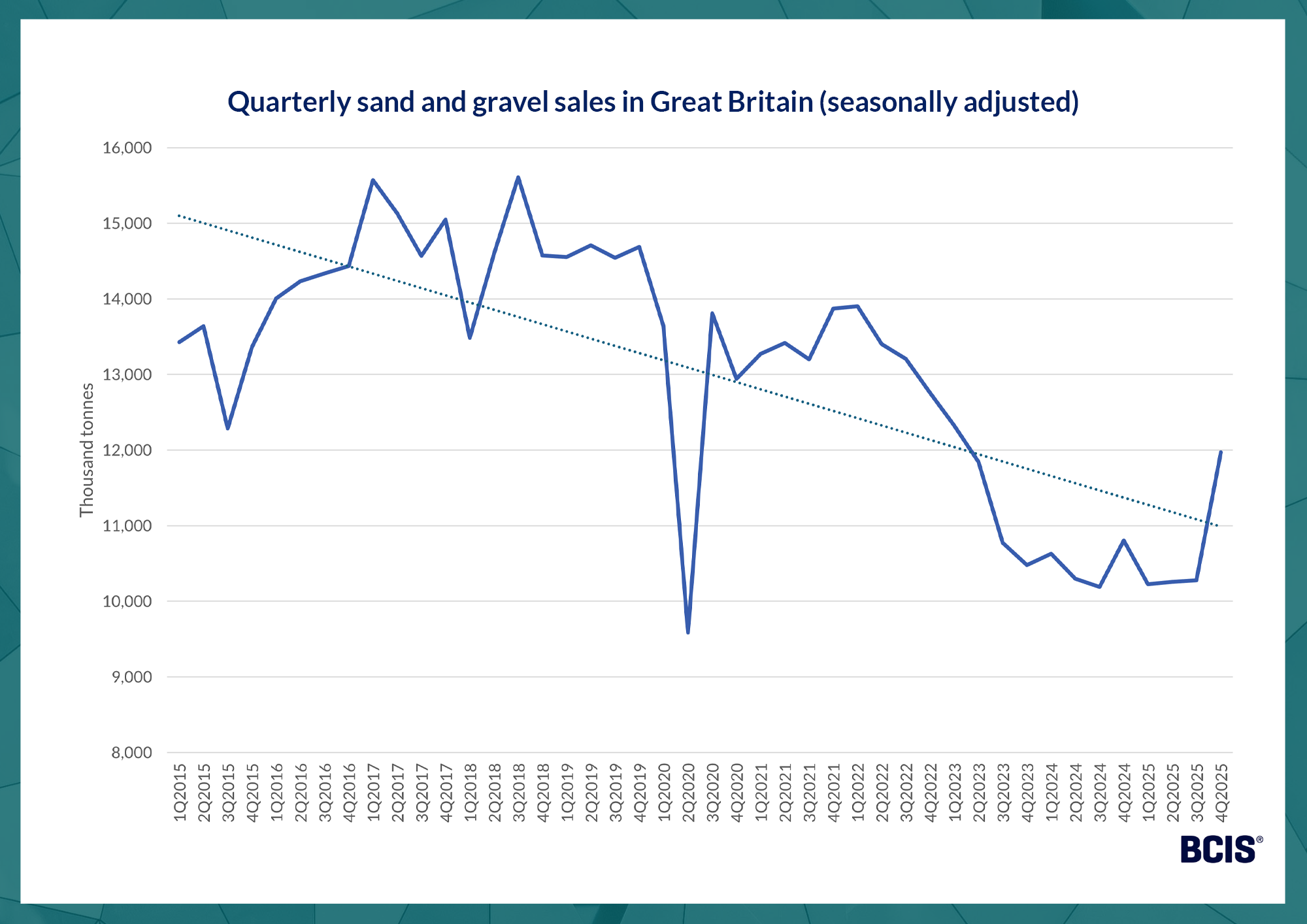

Elsewhere, DBT data going back to 2013 show a longer-term decline in annual ready-mixed concrete deliveries and sand and gravel sales (both seasonally adjusted).

In 2025, provisional figures suggest 11.0 million cubic metres of ready-mixed concrete were delivered – the lowest level in the published data.

Compared with 2024, this was a 10.1% annual decrease and a decline of almost one-third on deliveries in pre-pandemic 2019 and 2015.

Quarterly deliveries of ready-mixed concrete in 4Q2025 were the lowest on record, 2Q2020 excepted.

Source: Department for Business & Trade – Building materials and components statistics, Table 6b

Meanwhile, annual sand and gravel sales in 2025 were up 1.9% on 2024 but fell by 27.0% and 19.0% in six and 10 years respectively. 1Q2025 saw the lowest level of sales of the available data, 2Q2020 excepted.

Source: Department for Business & Trade – Building materials and components statistics, Table 4b

New economic data from the Mineral Productions Association (MPA)(2) indicate that demand for core construction materials is weak with demand for key materials including concrete, aggregates and asphalt declining for the fourth consecutive year in 2025.

MPA insights also exposed a record 27% fall in annual materials sales volumes in the London market last year including a notable downturn in demand for ready-mixed concrete.

‘New data from both the Mineral Products Association (MPA) and the Department for Business and Trade (DBT) highlight an alarming, long-term fall in demand for key construction materials,’ Dr Crosthwaite added.

‘Together, the data echo the deepening demand crisis in construction’s residential market. Developers are stuck. They face decision-making holdups at regulatory and government levels, reduced buyer appetite and high costs from levies and rising building costs. It’s a recipe we’ve seen the result of time and again in delayed starts, site closures and missed housing targets.

‘The greater concern is the long-term damage to domestic supply chains and whether manufacturers will be able to weather demand stagnation. Further reductions in supply chain capacity could be disastrous for national housing and infrastructure targets.

‘How swiftly and how well measures like the government’s renegotiation of Section 106 agreements answer the severity of demand pressures, are of the utmost importance.’

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.