If you are a housebuilder or developer, please fill in the survey. If you have any questions or would like to discuss the survey, please call +44 0330 341 1000 or email contactbcis@bcis.co.uk

Published: 19/02/2026

The Office for National Statistics (ONS) publishes quarterly data(1) measuring the number of employees and self-employed people in the UK by industry and gender. This data, which is not seasonally adjusted, is based on the Labour Force Survey (LFS) and aims to provide a current snapshot of employment trends and insight into the labour markets of specific industries.

In the last couple of years, ONS has made several changes to address quality concerns with the LFS(2) and caution has been advised in using these statistics.

ONS also publishes monthly data on the number of vacancies and jobs in the UK by industry. This data, which is seasonally adjusted, is based on the Vacancy Survey, a monthly survey of businesses that provides a comprehensive measure of the total number of vacancies across the economy.

Construction workforce shrinks by more than 300,000 workers in 20 years

The UK construction workforce (not seasonally adjusted) shrank by more than 300,000 workers between 2005 and 2025, new employment data from the ONS suggests.

Across the four quarters of 2025(3), an average of 2,070,035 people were estimated to be working in construction last year, a 0.9% decrease on the 2024 average and a 13.0% fall compared with 2,379,276 workers in 2005, prior to the global financial crisis.

Dr David Crosthwaite, chief economist at BCIS, said: ‘The latest figures reinforce the capacity constraints that construction businesses continue to report. A 13% contraction of the workforce over two decades is no coincidence – it’s the result of several economic and political shocks occurring in succession, coupled with a slow-growth economy, inflated costs and prices and difficulties attracting and retaining future generations of workers.’

The latest ONS data show there were an estimated 2,045,781 people working in construction in the final quarter of 2025. This was a 0.3% rise on 3Q2025 but a year-on-year fall of 3.9% on 4Q2024.

Compared with 4Q2005, the workforce at the end of 2025 was smaller by 334,199 workers, a decline of 14.0%, making it the second lowest quarterly total recorded in the past 25 years.

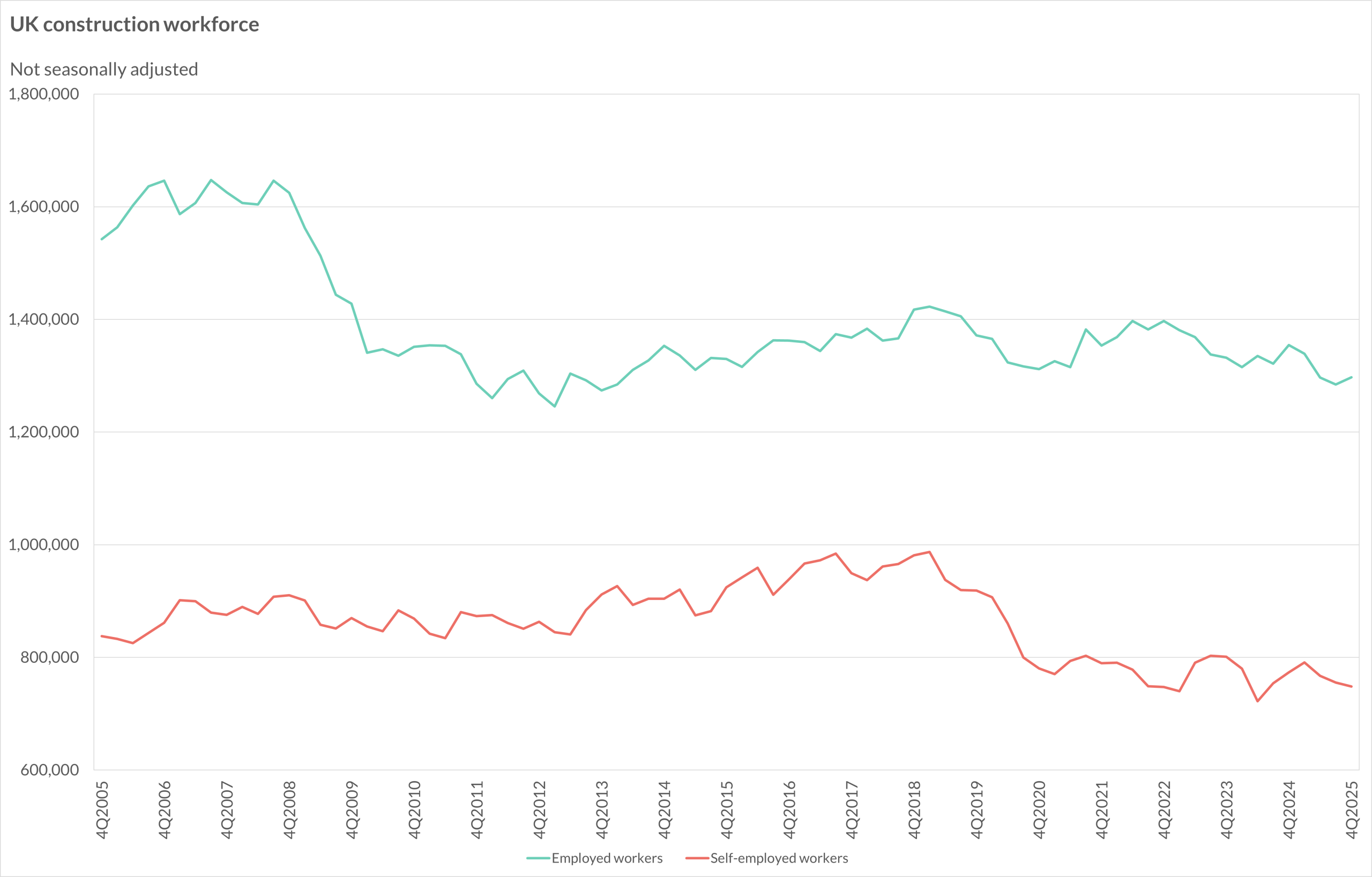

Employed and self-employed workers

In 4Q2025, there were an estimated 1,297,331 employed workers and 748,450 self-employed workers in construction. Self-employed workers accounted for 37% of the overall workforce, the same proportion as has been the overall average level of self-employment in the sector since 1997.

The number of employed workers in 4Q2025 was up by 1.0% on the quarter but down by 4.2% on the year.

Self-employed workers in construction decreased on the quarter by 0.9% and by 3.2% on the year.

The volumes of employed and self-employed workers were both smaller than they were in 4Q2005 by more than one-tenth.

Dr Crosthwaite added: ‘There are two notable features of construction’s long-term workforce contraction. First is the sharp drop-off in self-employed numbers since 2019, likely a combined result of Brexit, the pandemic and retirements. It means there’s currently less flexibility to react to changes in demand.

‘Second is construction’s relative position within the wider economy workforce. It has experienced the second largest declines in employed and self-employed workers of all sectors in the last two decades. The exceptions are manufacturing, with a 19% contraction in employed numbers, and wholesale, retail and repair of motor vehicles, with a 24% decline in self-employed workers.

‘Part of the problem with construction’s labour capacity is its deep ties to economic growth and investment sentiment. When confidence is low among clients and funders, decision-making and project starts are delayed which influences longer-term employment decisions made by contractors and subcontractors. In other words, they’re less likely to invest in training and apprenticeships because future cash flow is uncertain.

‘This is compounded by other factors like tax, increasing building costs and people leaving the industry. The broader risk is not having enough people to deliver work if demand increases at some point. This could result in higher tender prices for clients and reduced project viability.’

Source: ONS – EMP14: Employees and self-employed by industry.

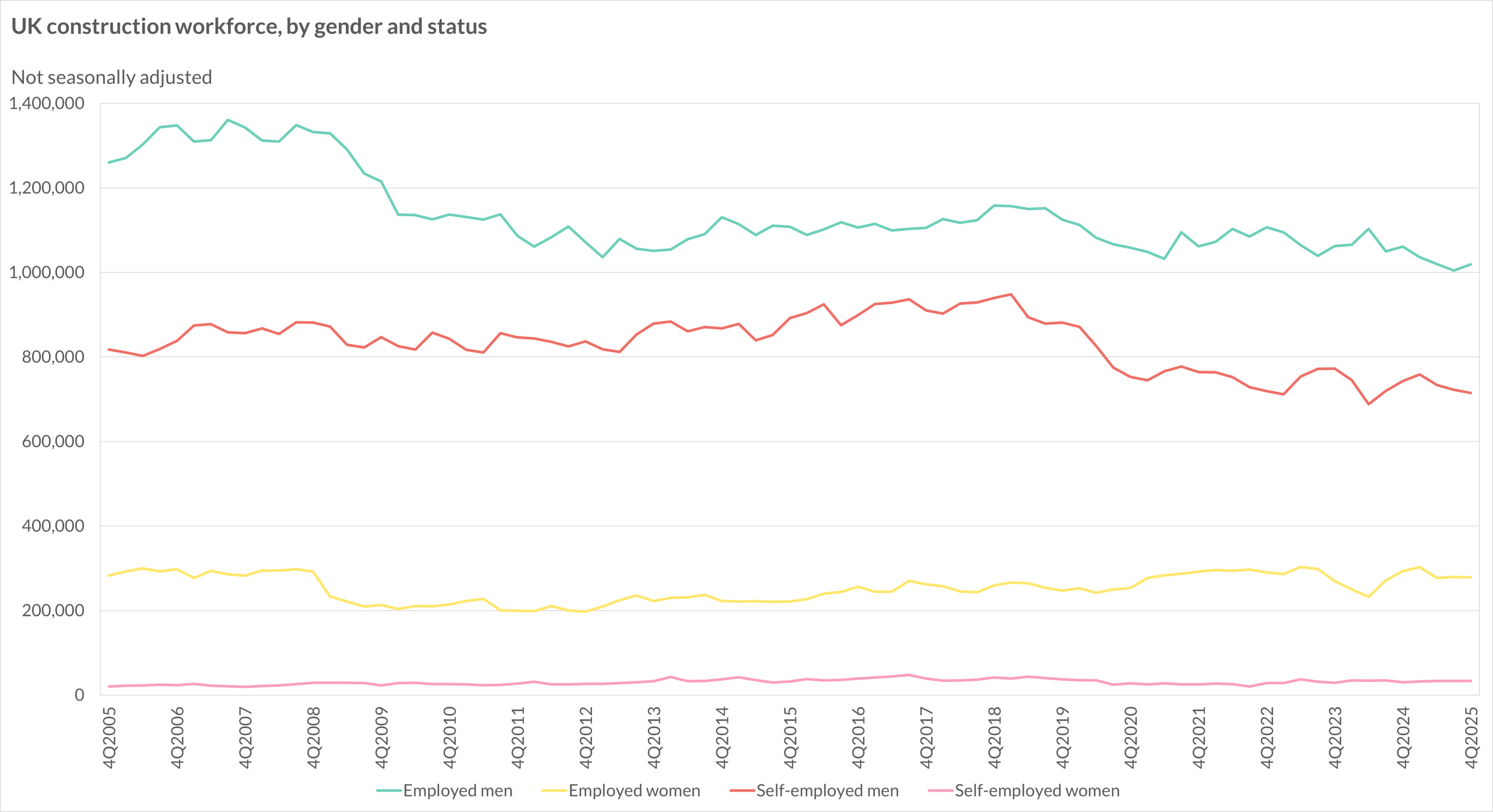

The construction gender divide

By gender, 85% of construction workers in 4Q2025 were men, with an estimated 311,750 women working in the industry in total.

Among employed workers, the number of male workers increased on the quarter by 1.4% while the number of women employees decreased by 0.5% in the same period. Year-on-year, the number of employed men in construction decreased by 4.0% in the final quarter of 2025 and employed women fell by 5.1%.

By comparison, self-employed men decreased by 1.0% on the quarter and by 3.8% annually. The number of self-employed women rose by 0.9% on 3Q2025 and by 11.0% on the year.

Source: ONS – EMP14: Employees and self-employed by industry.

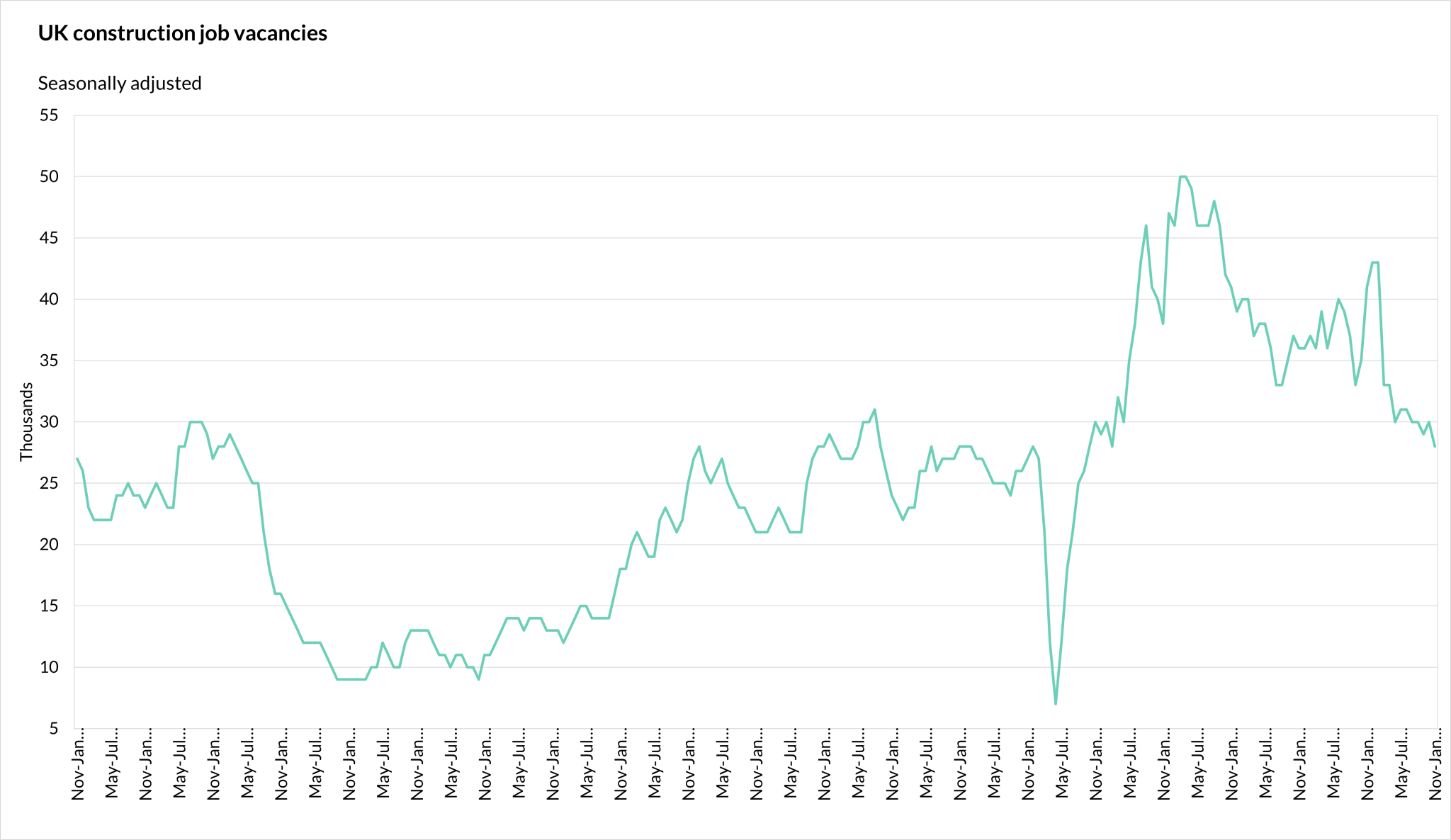

Job vacancies in construction

New figures from the ONS Vacancy Survey – a monthly survey that provides estimates of the number of available positions in the economy – show that in the three months to January 2026, there were around 28,000 job vacancies in the construction sector (seasonally adjusted)(4), at a ratio of 1.8 vacancies per 100 filled positions (excluding self-employment).

Compared with the same period in 2025, this was approximately 13,000 fewer vacancies.

Source: ONS – VACS02: Vacancies by industry.

Dr Crosthwaite added: ‘Construction vacancies are the lowest they’ve been since the three-month period ending in April 2021. Despite the sector seemingly needing more workers, current economic and demand conditions are not robust enough to incentivise a recruitment drive just yet.

‘Taken with the latest workforce and output data, there seems a real and urgent need for government intervention to improve operating conditions for businesses. A more concerted, joint effort between the government and the industry to encourage the uptake and completion of apprenticeships is also necessary to reinforce the talent pipeline.’

To keep up to date with the latest industry news and insights from BCIS, register for our newsletter here.

(1) Office for National Statistics – EMP14: Employees and self-employed by industry - here

(2) Office for National Statistics – Labour Force Survey quality update: September 2025 - here

(3) The figure used is an average of the combined number of employed and self-employed people working in construction each quarter in 2025.

(4) Office for National Statistics – VACS02: Vacancies by industry - here